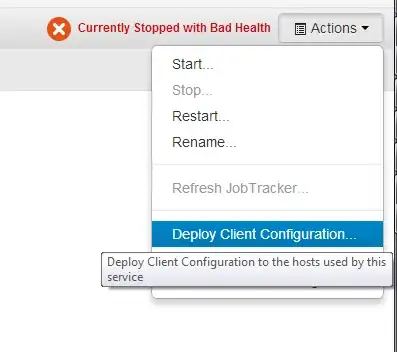

I want to calculate the tax on the amount based on tax bracket applied to it in Google sheet. Here is the screenshot of the tax bracket:

So if the amount is $17000, then 10.5% tax is applied on first $14000 and 17.50% tax should be applied on the remaining $3000. I have tried the following formula but I don't think this is the optimal way of calculating this, J13 cell has a value to be calulated for the taxable amount:

=IFS(J8<14001,14000*0.105,J8<48001,1470+(J8-14000)*0.175,J8<70001,7420+(J8-48000)*0.30) and so on for other tax ranges

I donot want to use this tax table in the formula, due to my beginner skills with the formulas, I am unable to devise a optimal formula which works without using tac table, any guidance would be much appreciated.