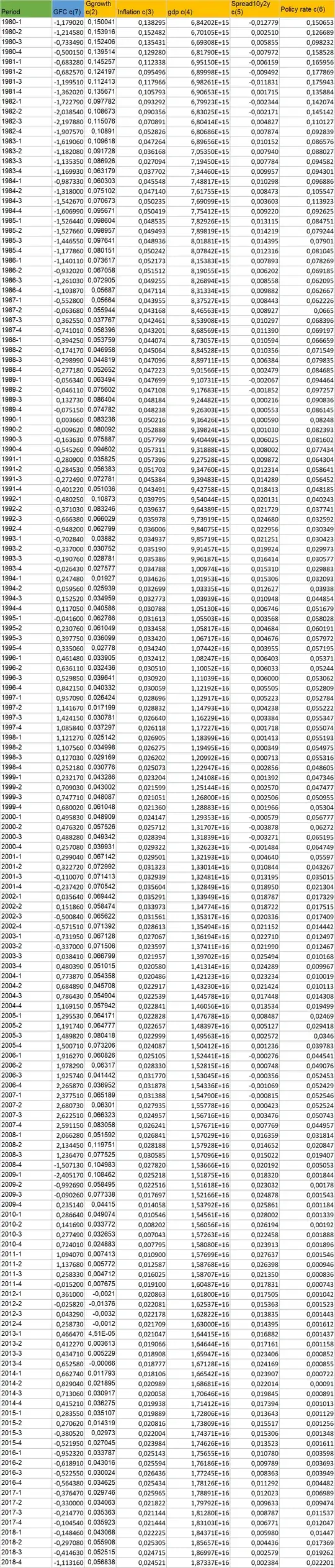

I'm doing an OLS regression to estimate the global financial cycle from 1980q2 to 2018q4. I have to use all dependent variables in growth rate but when I use GDP in growth rate I get non-significant results whereas if I use it in levels I get a significant result.

These are the data I'm using in the first case:

And I have this output:

And I have this output:

Instead these are the data I'm using in the second case:

And this is the output:

And this is the output:

The regression I'm doing using Eviewsis: gfc=C(1)+C(2)*ggrowth(-1)+C(3)*inflation(-1)+C(4)*gdp(-1)+C(5)*spread10y2y(-1)+C(6)*policyrate(-1)+C(7)*gfc(-1)

All dependent variables are lagged by one period

I'm taking the data from

inflation USA: https://fred.stlouisfed.org/series/CORESTICKM159SFRBATL#0

policy rate USA: https://fred.stlouisfed.org/series/DFF#0

spread 10y2y USA: https://fred.stlouisfed.org/series/T10Y2Y#0

gdp USA: https://fred.stlouisfed.org/series/GDPC1#0

g usa: (https://fred.stlouisfed.org/series/W068RCQ027SBEA)

Can you help me understanding if the regression I've done is correct? Or can you help me doing the right regression to have a significant result? Thank you very much.