I don't understand how strategy.max_drawdown and strategy.max_runup are calculated on TradingView Pine Script. My problem is the documented calculation just not correct if there are multiple exit points.

I know what is max drawdown and runup, but TradingView calculates different way than it is logical for me.

I have the following pine script:

//@version=5

strategy("StratTest", overlay=true, precision = 10, initial_capital=1000, default_qty_type=strategy.fixed, default_qty_value=100,

commission_type=strategy.commission.cash_per_contract,

commission_value=0.033)

var float limit = na

var float stop = na

var float tp1 = na

var float tp2 = na

if bar_index == 860

limit := math.round_to_mintick(close + 10 * syminfo.mintick)

stop := math.round_to_mintick(high + 70 * syminfo.mintick)

tp1 := math.round_to_mintick(low - 20 * syminfo.mintick)

tp2 := math.round_to_mintick(low - 200 * syminfo.mintick)

strategy.entry("Entry", strategy.short, limit=limit)

strategy.exit("Exit/1", "Entry", stop=stop, limit=tp1, qty_percent = 50)

strategy.exit("Exit/2", "Entry", stop=stop, limit=tp2, qty_percent = 50)

plotchar(strategy.max_drawdown, "max_drawdown", '', location.top, color=color.yellow)

plotchar(strategy.max_runup, "max_runup", '', location.top, color=color.yellow)

plotchar(strategy.opentrades.max_drawdown(0), "opentrades.max_drawdown(0)", '', location.top, color.gray)

plotchar(strategy.opentrades.max_runup(0), "opentrades.max_runup(0)", '', location.top, color.gray)

plotchar(strategy.closedtrades.max_drawdown(0), "closedtrades.max_drawdown(0)", '', location.top, color.white)

plotchar(strategy.closedtrades.max_drawdown(1), "closedtrades.max_drawdown(1)", '', location.top, color.white)

plotchar(strategy.closedtrades.max_runup(0), "closedtrades.max_runup(0)", '', location.top, color.white)

plotchar(strategy.closedtrades.max_runup(1), "closedtrades.max_runup(1)", '', location.top, color.white)

If I run this on CAPITALCOM:GBPJPY 15 min interval on TradingView, the strategy.max_drawdown will be 6.00. How is it possible?

Without commission strategy.max_drawdown is 3.45. How it is calculated?

My calculations

My start equity is 1000. I sell 100 contracts at 152.873 , high is 152.9, low is 152.823

The order of execution is o→h→l→c

The equity at low price: 1005, at high: 997.3. -> Runup: 5, drawdown 2.7

This is the same on TradingView so it is OKBuy back 50 (from 100) contracts at 152.8, high is 152.861 low is 152.794

The order of execution is o→h→l→c

The equity at high is 1000 - 100 * (152.861 - 152.873) = 1001.2

Then the order is executed at 152.8, profit: -50 * (152.8 - 152.873) = 3.65

The remaining reach low, so the equity on low will be: 1000 + 3.65 - 50 * (152.794 - 152.873) = 1007.6

So the max drawdown is still 2.7 but runup changes to 7.6. It is still OKBuy back 50 (from 50) contracts at 152.969, high is 152.982 low is 152.829

The order of execution is o→l→h→c

So the equity at low is 1000 + 3.65 - 50 * (152.829 - 152.873) = 1005.85

Then the order is executed at 152.969, profit: -50 * (152.969 - 152.873) = -4.8

The equity: 1000 + 3.65 - 4.8 = 998.85

So the max drawdown is still 2.7 and runup is still 7.6 . It is not OK, on TradingView drawdown is 3.45 . How is it possible?

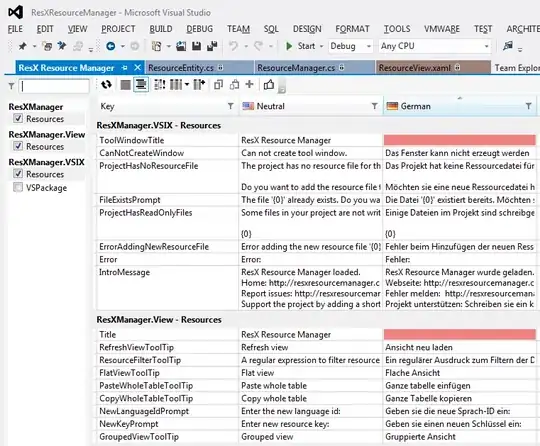

The list of trades when commission is used: