I am trying to run a forecast of bitcoin returns with the sentiment score of twitter. However, after running the following code I get a plot for the forecast but with just a horizaontal line. Seems weird, since it does not go up or down. This is my code prior the forecasting:

adf.test(BTC_USD_data$total_score)

ggAcf(BTC_USD_data$total_score)

ggPacf(BTC_USD_data$total_score)

#Bitcoin returns

adfTest(BTC_USD_data$return)

plot(BTC_USD_data$return)

ggAcf(BTC_USD_data$return)

ggPacf(BTC_USD_data$return)

m1 <- auto.arima(BTC_USD_data$return, xreg = BTC_USD_data$total_score, trace = TRUE, seasonal = FALSE, stepwise = FALSE, approximation = FALSE)

#4,0,0

summary(m1)

autoplot(m1)

checkresiduals(m1)

test(resid(m1))

adf.test of BTC_USD_data$total_score is:

Warning: p-value smaller than printed p-value

Augmented Dickey-Fuller Test

data: BTC_USD_data$total_score

Dickey-Fuller = -8.7682, Lag order = 23, p-value = 0.01

alternative hypothesis: stationary

ACF and PACF for the total_score are:

The summary of the first auto.arima model m1 is:

Series: BTC_USD_data$return

Regression with ARIMA(4,0,0) errors

Coefficients:

ar1 ar2 ar3 ar4 intercept xreg

-0.0057 -0.0233 0.0003 -0.0364 2e-04 0

s.e. 0.0089 0.0088 0.0091 0.0095 1e-04 0

sigma^2 = 7.837e-05: log likelihood = 43352.11

AIC=-86690.21 AICc=-86690.21 BIC=-86637.85

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set -2.397527e-07 0.008850779 0.005827579 -Inf Inf 0.6825662 -0.0001918203

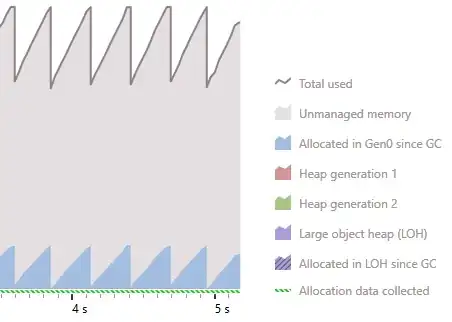

The autoplot for the first model from the auto.arima is

Then I just a train part and a test part for BTC and also the xreg(tweets sentiment total score). Eventually running the auto.arima on the train part and forecasting. However, before doing that I made a new time series with only containing the total score of a tweet and the return on that time. :

BTC_tweets_df <- as.data.frame(cbind(BTC_USD_data$return, BTC_USD_data$total_score))

colnames(BTC_tweets_df) <- c("return", "total_score")

BTC_TS <- ts(BTC_tweets_df, frequency = 60 , start = c(2021, 12), end = c(2022, 06))

btc_train <- window(BTC_TS, end = c(2022, 01))

btc_test <- window(BTC_TS, start = c(2022, 01))

forecastbtc <- forecast(arimabtc_train, xreg = rep(btc_test), 2)

autoplot(forecastbtc)

This results in the following autoplot of the forecast:

The forecast does not seem to be legitimate. Either I am doing something wrong, or something else is going on. Anyone an idea?