I need some help on a simple strategy code I have written. This is my 1st code on it. I have an issue with mon code written on PineScript.

PineScript doesnt calculate my SL, TP and quantity size properly and I cannot figure out why.

My strategy is : when there are 4 green candles in a row after 1 red candle, to enter a long position on the 5th candle (no matters if it is red or green).

the SL price = (the close price of the 4th green candle from the red candle + the open price of the 2nd green candle from the red candle)/2

Diff = Difference between entry price - SL price. This value in price will be used to calculate the TP price

the TP price = entry price + (2*Diff) The "2" means I have a risk reward of 2, I risk 1 to win 2.

Also I want to risk 1% on each trade of my account balance. For example if my account balance is 200 000$, I want to risk 2000$ So if the Diff (Difference between entry price - SL price) is 2$, I want to buy 1000 units of the share for ETH as 2000$/2$. Based on my risk reward, all my lossing trades should always be 1% of my account balance and all my winning trades should always be 2%. But when I look at the trades, the percentages dont follow anything.

But PineScript doesnt do it properly. It does detect the pattern that I want to trade and goes in in the 5th candle but the exit point doesnt work properly either the SL or TP and quantity.

I dont know if my instructions of the SL is wrong or whatever. Do you have any idea ?

This is my current code and see below some picture of the trades :

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

strategy("4 Green Candle Strategy", overlay=true,shorttitle = "4GCS")

// 1. User Input //

i_rewardmulti = input.float(2.0, "Risk Reward", minval = 1.0, step = 0.5, group = "4 Green Candle Strategy Settings")

i_risk = input.float(1.0, "Percentage to risk per trade", minval = 0.1, step = 0.05, group = "4 Green Candle Strategy Settings")

ibtstarttime = input.time(title="Start Backtest", defval=timestamp("01 Jan 2022 00:00 +0000"), group="Backtest Period")

ibtendtime = input.time(title="End Backtest", defval=timestamp("01 Jan 2099"), group="Backtest Period")

// ---------------------------------------------------- Strategy Settings -----------------------------------------------//

// 2. Conditions of a valid setup //

ValidSetup = close[4] < open[4] and close[3] > close[4] and close[2] > close[3] and close[1] > close[2] and close > close[1] and barstate.isconfirmed

// 3. Confirmation of a valid setup //

ValidLong = ValidSetup and strategy.position_size==0 and barstate.isconfirmed

// 4. Calculation of TP, SL, balance risked and position size risked //

EntryPrice = close

long_SLprice = (close + open[2])*0.5

long_diff_EntryPrice_and_StopLossExitPrice = close - long_SLprice

long_TPprice = EntryPrice + (i_rewardmulti * long_diff_EntryPrice_and_StopLossExitPrice)

balance = (strategy.initial_capital + strategy.netprofit)

balance_limited = (balance > 0 ? balance : 0)

balance_risked = (i_risk/100) * balance

position_size_risked = (balance_risked/long_diff_EntryPrice_and_StopLossExitPrice)

// 5. Save of SL, TP and position size if a valid setup is detected //

var trade_entry = 0.0

var trade_SL = 0.0

var trade_TP = 0.0

var trade_direction = 0

// 6. Detection of a valid long and trigger alerts //

trade_entry := EntryPrice

trade_SL := long_SLprice

trade_TP := long_TPprice

trade_direction := 1

// 7. Enter a trade whenever a valid setup is detected //

if ValidLong

strategy.entry("Long", strategy.long, qty=position_size_risked)

// 8. Exit a trade whenever a TP or SL is hit //

if strategy.position_size > 0

strategy.exit("Long Exit", from_entry = "Long", limit= trade_TP, stop = trade_SL)

// 9. Draw trade data and Price action setup arrow //

plot (series = strategy.position_size !=0 and ValidLong ? trade_SL : na, title = "Trade Stop Price", color=color.red, style = plot.style_linebr)

plot (series = strategy.position_size !=0 and ValidLong ? trade_TP : na, title = "Trade TP Price", color=color.green, style = plot.style_linebr)

plotshape(series = ValidLong ? 1 : na, style =shape.triangleup, location = location.belowbar, color=color.green, title = "Bullish Setup")

// ------------------------------------------------------ End of Code -------------------------------------------------//

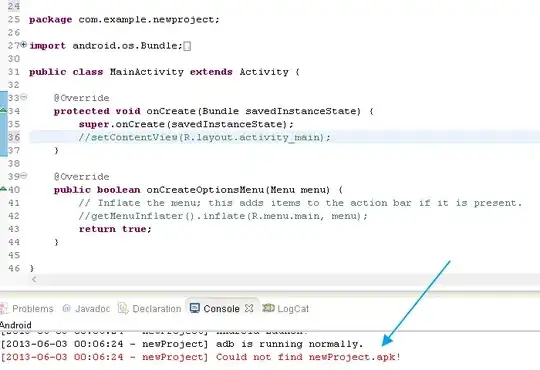

Normally on the trade which started at 22.00 (10pm) after it detected 4 green candles after 1 red candle, based on my TP strategy, it should have exit at 1212.84$ after the TP value was 1.84$ but it exit at a higher price that it was supposed to do. And the profit in percentage is 1.57% when it should always be 2% and you can see below on a lossing trade, the percentage lost is 0.12% when it should always be 1%.

Do you have any idea on why it does work properly ? Is there a mistake in my code ?

Thanks, Ulrich

I tried to change number the reference of the candle eg candle [2] to candle [1], the detection went wrong.