It's the end of January and that magical feeling of "tax time" is starting up around the world. A common problem is to calculate tax owed based on a set of tax brackets and rates. This is also similar to calculating total order costs based on a quantity and volume discounted prices.

I've seen some old questions/answers based on this problem type, but none are treating it as a general function, so I thought I would post one here. The idea is to create a general solution using LET which can be wrapped into LAMBDA when that is available.

US Federal Income Tax Rates 2021

So, let's start with the 2021 US Federal Income Tax Tables as an example:

| Tax rate | Single From | Single To | Head of household From | Head of household To | Married filing jointly From | Married filing jointly To | Married filing separately From | Married filing separately To |

|---|---|---|---|---|---|---|---|---|

| 10% | - | 9,950 | - | 14,200 | - | 19,900 | - | 9,950 |

| 12% | 9,951 | 40,525 | 14,201 | 54,200 | 19,901 | 81,050 | 9,951 | 40,525 |

| 22% | 40,526 | 86,375 | 54,201 | 86,350 | 81,051 | 172,750 | 40,526 | 86,375 |

| 24% | 86,376 | 164,925 | 86,351 | 164,900 | 172,751 | 329,850 | 86,376 | 164,925 |

| 32% | 164,926 | 209,425 | 164,901 | 209,400 | 329,851 | 418,850 | 164,926 | 209,425 |

| 35% | 209,426 | 523,600 | 209,401 | 523,600 | 418,851 | 628,300 | 209,426 | 314,150 |

| 37% | 523,600 | 523,600 | 628,300 | 314,151 |

So the question is - what is the total tax owed for a given taxable income? For example, 100k. (The correct answer is 18021)

Volume Discount Pricing

Let's also take another example of the same family - volume discounted pricing. Here is a table showing order quantity and unit prices for each tranche of order quantity.

| Qty From | Qty To | Unit Price |

|---|---|---|

| 0 | 100 | 16.00 |

| 101 | 250 | 14.40 |

| 251 | 500 | 12.96 |

| 501 | 1000 | 11.66 |

| 1001 | 2000 | 10.49 |

| 2001 | 5000 | 9.44 |

| 5001 | 10000 | 8.50 |

A question might be: what would an order of 1200 units cost? (The correct answer is 14928)

How the Calculation Works

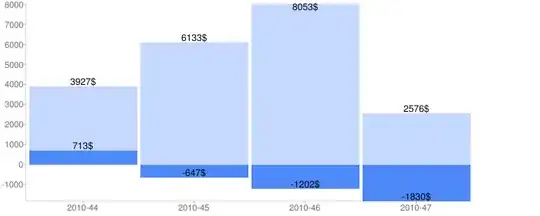

Both the tax table and volume discounting calculate by accumulating across the brackets at each tax rate or discounted unit price.

Example - tax calc A Single Person with taxable income of 50,000 would have taxes of:

9950 * 10% +

(40525-9950) * 12% +

(50000-40525) * 22% = 6748.50

Example - volume discounting An order of 220 units would pay 16 per unit for the first 100 and and 14.40 per unit of the next 120:

100 * 16.00 +

(220-100) * 14.40 = 3328

Objective

Have a formula that can be used for general purpose volume discounting or tax table calculation.

I will post my own solution, but I will not mark is as the answer - I'm sure there are better solutions out there and perhaps someone with LAMBDA can show how this can be built as a general solution.

Related Questions

IF statement to return different values for 3+ conditions

Complicated formula required to work out costs including multiple discounts