I have the following data (cost of a product vs. time) that looks like the following:

annum <- c(1903, 1904, 1905, 1906, 1907, 1908, 1909, 1910, 1911, 1912, 1913,

1914, 1915, 1916, 1917, 1918, 1919)

cost <- c(0.0000, 18.6140, 92.1278, 101.9393, 112.0808, 122.5521,

133.3532, 144.4843, 244.5052, 275.6068, 295.2592, 317.3145,

339.6527, 362.3537, 377.7775, 402.8443, 437.5539)

mydata <- as.data.frame(cbind(annum, cost))

g <- ggplot(mydata, aes(x = annum, y = cost))

g <- g + geom_point()

g <- g + scale_y_continuous(labels=scales::dollar_format())

g

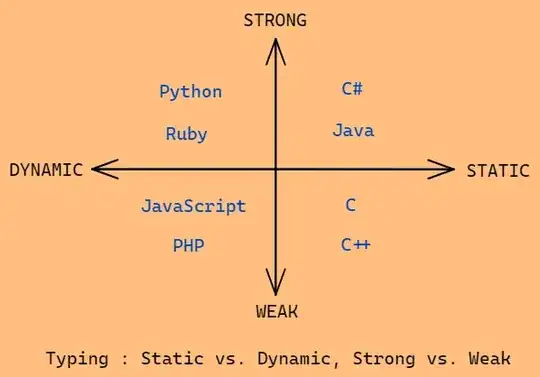

This is the resulting plot of this data using this code The plot shows something that looks piecewise linear to me; there's a step from 1904 to 1905; then a clear line from 1905 to 1910; then a step; and then another line from 1911 to the end. (The first point (1903, 0) is fictitious.)

I've tried to use the segmented package to model this, but instead of picking something like 1904.5 and 1910.5 as breakpoints, it finds two points between 1911 and 1912.

I've tried some other techniques (e.g., "brute force" from "The R Book," and direct fitting), but I clearly don't understand this as much as I need to. Any help would be very much appreciated.

Ideally, I would end up with an equation for each segment and a single plot showing the piecewise fit and a confidence interval for the fit.