My strategy() is fully working but now I'm trying to manage how money is put in the trade.

HERE'S MY CURRENT SITUATION :

I have a SL set at the lowest low of the last 10 bars and a TP set at 1.5xSL.

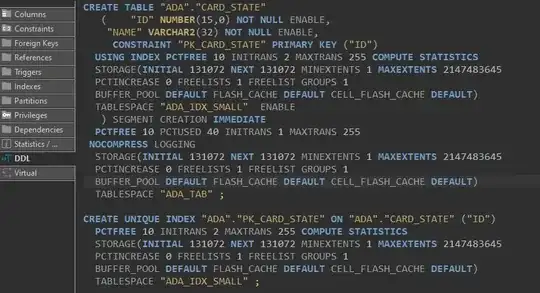

My strategy.exit :

strategy.exit("EXIT LONG","LONG", stop=longSL, limit=longTP)

Until here, everything is working fine.

THE PROBLEM :

Even though I use :

strategy("TEST MACD DEFAULT", shorttitle="MACD", overlay=true, initial_capital=1000, default_qty_type=strategy.equity, default_qty_value=1, currency=currency.EUR, process_orders_on_close=true, pyramiding=0)

The money is not put in the trade the way I want.

WHAT I WANT :

I have a capital of 1000€.

I want my SL (which is already set at the lowest low of the last 10 bars) to be 1% of my capital = 10€.

My TP being 1.5xSL, so it would be 15€.

Meaning that for each trade I lose, I lose 10€ and for each trade I win, I win 15€.

But this is not what I have :

QUESTION :

How can I achieve this ?

HERE'S MY CODE (only for long positions) :

//@version=4

strategy("TEST MACD DEFAULT", shorttitle="MACD", overlay=true, initial_capital=1000, default_qty_type=strategy.cash, default_qty_value=10, currency=currency.EUR, process_orders_on_close=true, pyramiding=0)

// MACD

[macdLine, signalLine, _] = macd(close, 12, 26, 9)

// EMA 200

ema = ema(close, 200)

plot(ema, title="EMA 200", color=color.yellow, linewidth=2)

// LONG CONDITIONS

longCheckCondition = barssince(crossover(macdLine, signalLine))

longCondition1 = longCheckCondition <= 3 ? true : false

longCondition2 = macdLine < 0 and signalLine < 0

longCondition3 = close > ema

longCondition = longCondition1 and longCondition2 and longCondition3 and strategy.opentrades == 0

// STOP LOSS

float longSL = na

longSL := longCondition ? lowest(low, 11)[1] : longSL[1]

// TAKE PROFIT

longEntryPrice = close

longDiffSL = abs(longEntryPrice - longSL)

float longTP = na

longTP := longCondition ? close + (1.5 * longDiffSL) : longTP[1]

// ENTRY/EXIT

if longCondition

strategy.entry("LONG", strategy.long)

strategy.exit("EXIT LONG","LONG", stop=longSL, limit=longTP)

// PLOT STOP LOSS

longPlotSL = strategy.opentrades > 0 and strategy.position_size > 0 ? longSL : na

plot(longPlotSL, title='LONG STOP LOSS', linewidth=2, style=plot.style_linebr, color=color.red)

// PLOT TAKE PROFIT

longPlotTP = strategy.opentrades > 0 and strategy.position_size > 0 ? longTP : na

plot(longPlotTP, title='LONG TAKE PROFIT', linewidth=2, style=plot.style_linebr, color=color.green)