I am trying to use an ARIMA model to predict stock price data, specifically, I am using auto_arima. My goal is to predict the next 30 days of stock prices and compare it to the test data.

I am unable to predict the data correctly as seen in the graph below.

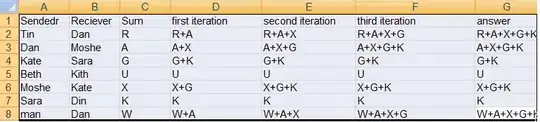

Here is the code I used:

#general

import pandas as pd

import numpy as np

import matplotlib.pylab as plt

%matplotlib inline

import yfinance as yf

ticker = "0118.KL"

data = yf.Ticker(ticker)

df = data.history(start="2019-01-01",end="2020-04-30")

df = df.filter(items=['Close'])

train = df[:-30]

test = df[-30:]

from pmdarima import auto_arima

model = auto_arima(train,trace=True,m=7,error_action='ignore', suppress_warnings=True)

model.fit(train)

forecast = model.predict(n_periods=30)

forecast = pd.DataFrame(forecast,index = test.index,columns=['Prediction'])

plt.plot(test, label='Valid')

plt.plot(forecast, label='Prediction')

plt.show()

Any idea on how to get a better fit? Thank you for reading.