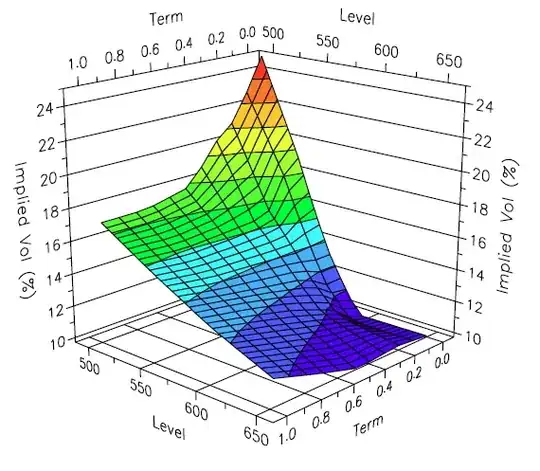

I'd like to calculate the local volatility surface for a series of option strikes, similar to the surface described in this paper:

http://www.ederman.com/new/docs/gs-local_volatility_surface.pdf

This is the image I am referring to in the aforementioned paper:

I know QuantLib has the ability to do this - but does anyone know the correct C# function call(s)?

I'm using the C# build of QuantLib, from: http://www.resolversystems.com/products/quantlib-binary/