I have 3 months of data (each row corresponding to each day) generated and I want to perform a multivariate time series analysis for the same :

the columns that are available are -

Date Capacity_booked Total_Bookings Total_Searches %Variation

Each Date has 1 entry in the dataset and has 3 months of data and I want to fit a multivariate time series model to forecast other variables as well.

So far, this was my attempt and I tried to achieve the same by reading articles.

I did the same -

df['Date'] = pd.to_datetime(Date , format = '%d/%m/%Y')

data = df.drop(['Date'], axis=1)

data.index = df.Date

from statsmodels.tsa.vector_ar.vecm import coint_johansen

johan_test_temp = data

coint_johansen(johan_test_temp,-1,1).eig

#creating the train and validation set

train = data[:int(0.8*(len(data)))]

valid = data[int(0.8*(len(data))):]

freq=train.index.inferred_freq

from statsmodels.tsa.vector_ar.var_model import VAR

model = VAR(endog=train,freq=train.index.inferred_freq)

model_fit = model.fit()

# make prediction on validation

prediction = model_fit.forecast(model_fit.data, steps=len(valid))

cols = data.columns

pred = pd.DataFrame(index=range(0,len(prediction)),columns=[cols])

for j in range(0,4):

for i in range(0, len(prediction)):

pred.iloc[i][j] = prediction[i][j]

I have a validation set and prediction set. However the predictions are way worse than expected.

The plots of the dataset are -

1. % Variation

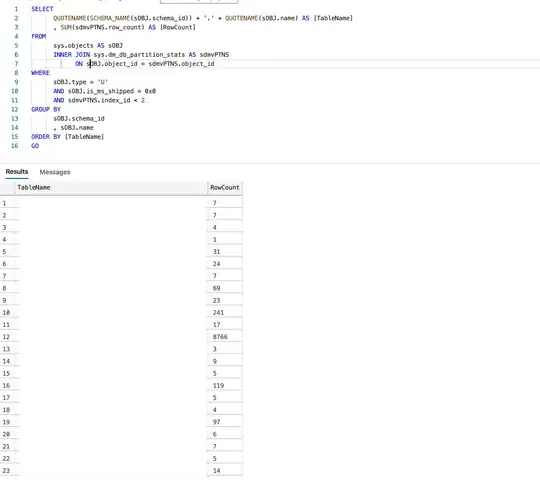

The output that I am receiving are -

Prediction dataframe -

Validation Dataframe -

As you can see that predictions are way off what is expected. Can anyone advise a way to improve the accuracy. Also, if I fit the model on whole data and then print the forecasts, it doesn't take into account that new month has started and hence to predict as such. How can that be incorporated in here. any help is appreciated.

EDIT

Link to the dataset - Dataset

Thanks