I have a difficulty understanding the ouput of quantmod when using the function getOptionChain.

For a reproducible example:

library(quantmod)

AAPL.2015 <- getOptionChain("AAPL", "2019/2021")

A truncated part of the output:

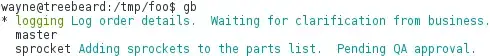

....

The Options that are currently traded on the other hand are the following:

First there is a discrepancy between what quantmod returns and the current situation. E.g., the call at strike $215 appears with Bid 7.95 and Ask 8.10 by the quantmod output while the true current terms are Bid 4.45, Ask 4.85.

More generally, how should I interpret the last digits of the option code the ones after capital letter C?