I am trying to solve an iterative problem in Excel. I want to be able to calculate the sum of rent for x years. The rent is increasing at a rate of 10 percent every year. I quickly came up with this python code on a REPL for clarity:

year = 6

rent = 192000

total_rent = rent

for x in range(1 , year):

rent= rent + .1*rent

total_rent = total_rent + rent

print(total_rent) # 1481397.12 is what it prints

This is a trivial problem in programming but I am not sure the best way to achieve this in excel.

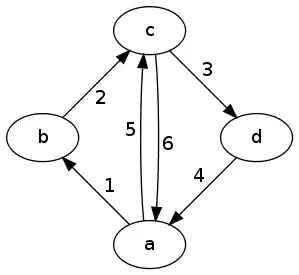

In excel I am doing it this something like this:

But all the intermediate rent amount(s) are not really needed. I guess there should be a for loop here as well too, but is there a mathematical representation of this problem which I can use to create the expected result?