I'm trying to create a Matplotlib graph that shows Bollinger Bands and price graph of cryptocurrency pairs on the Poloniex Exchange. The bands seem to work when I fetch data for the BTC/ETH pair but not for less active pairs such as BTC/BURST.

Here is a graph of the 30 minute candles for BTC/ETH

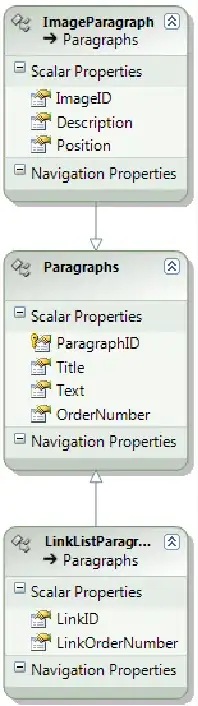

And here is a graph of 30 minute candles for BTC/BURST

It appears that the standard deviation for the BTC/ETH pair is calculated correctly and the bands are shown but the standard deviation of the BTC/BURST pair is always zero so the bands are drawn on top of the 10 day SMA.

Here is my code

import API

import numpy as np

from talib.abstract import *

import matplotlib.pyplot as plt

from matplotlib.finance import candlestick2_ohlc

import time

from pprint import pprint

key = 'keyHere'

secret = 'secretHere'

api = API.poloniex(key, secret)

pair = "BTC_BURST"

interval = 1800 # 30 mins

steps = 336 # 1 week

startTime = int(time.time()) - steps * interval

stopTime = int(time.time())

print 'fetching', steps, 'candles from server'

fetchStart = time.time()

data = api.api_query('returnChartData', {"currencyPair": pair, "period": interval,

"start": startTime, "end": stopTime})

print 'fetched', len(data['candleStick']), 'candles in', time.time() - fetchStart, 'seconds'

pprint(data)

inputs = {

'open': np.empty(steps),

'high': np.empty(steps),

'low': np.empty(steps),

'close': np.empty(steps),

'volume': np.empty(steps)

}

for x in range(0, steps):

candle = data['candleStick'][x]

inputs['open'][x] = candle['open']

inputs['high'][x] = candle['high']

inputs['low'][x] = candle['low']

inputs['close'][x] = candle['close']

inputs['volume'][x] = candle['volume']

pprint(STDDEV(inputs, timeperiod=10, nbdev=2))

upper, middle, lower = BBANDS(inputs, timeperiod=10, nbdevup=2, nbdevdn=2)

# pprint(upper)

# pprint(middle)

# pprint(lower)

candlestick2_ohlc(plt.gca(), inputs['open'], inputs['high'],

inputs['low'], inputs['close'], width=0.8)

plt.plot(upper)

plt.plot(middle)

plt.plot(lower)

plt.show()

IS this issue due to there being a higher volume on the BTC/ETH pair? Any help is greatly appreciated.