I am writing my master thesis at the moment, and I have some struggles with the eviews output. In my paper I investigate a credit rating change effect on the profitability of a firm, in this example measured with return on equity (ROE). I made dummy variables for each quarter, and a dummy 1 for an upgraded firm and 0 otherwise.

First I made a pooled OLS regression. This results in significant effect in the quarters following the event date. The results are logical and correspond to related literature. See reviews output.

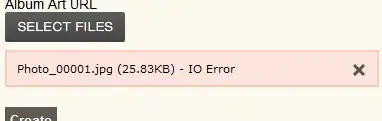

Now, I als employed a redundant fixed effect test for time FE and entity FE, both significant. Suggesting that I need to use both FE in my panel regression. If I do this, all results around a rating change period are insignificant. See figures for the output. Side note: the time FE give significant results, where the entity FE are highly insignificant. I cannot add these images.

My question is: what should I do? Use the pooled OLS output, or the FE regressions with strange and insignificant results? Or should I just us a single time FE?

Images: