You write:

the model doesn't give satisfactory results.

But what you mean is that the model isn't giving you the results you expect / want. i.e., you want the model to pick out periods the NBER has labeled as "Recessions", but the Markov switching model is simply finding the parameters which maximize the likelihood function for the data.

(The rest of the post shows results that are taken from this Jupyter notebook: http://nbviewer.jupyter.org/gist/ChadFulton/a5d24d32ba3b7b2e381e43a232342f1f)

(I'll also note that I double-checked these results using E-views, and it agrees with Statsmodels' output almost exactly).

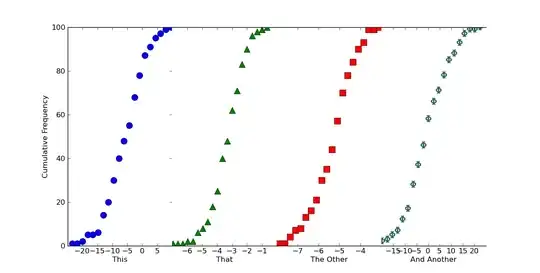

The raw dataset is the growth rate (log difference * 100) of real GNP; the Hamilton dataset versus one found on the Federal Reserve Economic Database are shown here, with grey bars indicating NBER-dated recessions:

In this case, the model is an AR(4) on the growth rate of real GNP, with a regime-specific intercept; the model allows two regimes. The idea is that "recessions" should correspond to a low (or negative) average growth rate and expansions should correspond to a higher average growth rate.

Model 1: Hamilton's dataset: Maximum likelihood estimation of parameters

From the model applied to Hamilton's (1989) dataset, we get the following estimated parameters:

Markov Switching Model Results

================================================================================

Dep. Variable: Hamilton No. Observations: 131

Model: MarkovAutoregression Log Likelihood -181.263

Date: Sun, 02 Apr 2017 AIC 380.527

Time: 19:52:31 BIC 406.404

Sample: 04-01-1951 HQIC 391.042

- 10-01-1984

Covariance Type: approx

Regime 0 parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -0.3588 0.265 -1.356 0.175 -0.877 0.160

Regime 1 parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 1.1635 0.075 15.614 0.000 1.017 1.310

Non-switching parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

sigma2 0.5914 0.103 5.761 0.000 0.390 0.793

ar.L1 0.0135 0.120 0.112 0.911 -0.222 0.249

ar.L2 -0.0575 0.138 -0.418 0.676 -0.327 0.212

ar.L3 -0.2470 0.107 -2.310 0.021 -0.457 -0.037

ar.L4 -0.2129 0.111 -1.926 0.054 -0.430 0.004

Regime transition parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

p[0->0] 0.7547 0.097 7.819 0.000 0.565 0.944

p[1->0] 0.0959 0.038 2.542 0.011 0.022 0.170

==============================================================================

and the time series of the probability of operating in regime 0 (which here corresponds to a negative growth rate, i.e. a recession) looks like:

Model 2: Updated dataset: Maximum likelihood estimation of parameters

Now, as you saw, we can instead fit the model using the "updated" dataset (which looks pretty much like the original dataset), to get the following parameters and regime probabilities:

Markov Switching Model Results

================================================================================

Dep. Variable: GNPC96 No. Observations: 131

Model: MarkovAutoregression Log Likelihood -188.002

Date: Sun, 02 Apr 2017 AIC 394.005

Time: 20:00:58 BIC 419.882

Sample: 04-01-1951 HQIC 404.520

- 10-01-1984

Covariance Type: approx

Regime 0 parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -1.2475 3.470 -0.359 0.719 -8.049 5.554

Regime 1 parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.9364 0.453 2.066 0.039 0.048 1.825

Non-switching parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

sigma2 0.8509 0.561 1.516 0.130 -0.249 1.951

ar.L1 0.3437 0.189 1.821 0.069 -0.026 0.714

ar.L2 0.0919 0.143 0.645 0.519 -0.187 0.371

ar.L3 -0.0846 0.251 -0.337 0.736 -0.577 0.408

ar.L4 -0.1727 0.258 -0.669 0.503 -0.678 0.333

Regime transition parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

p[0->0] 0.0002 1.705 0.000 1.000 -3.341 3.341

p[1->0] 0.0397 0.186 0.213 0.831 -0.326 0.405

==============================================================================

To understand what the model is doing, look at the intercepts in the two regimes. In Hamilton's model, the "low" regime has an intercept of -0.35, whereas with the updated data, the "low" regime has an intercept of -1.25.

What that tells us is that with the updated dataset, the model is doing a "better job" fitting the data (in terms of a higher likelihood) by choosing the "low" regime to be much deeper recessions. In particular, looking back at the GNP data series, it's apparent that it's using the "low" regime to fit the very low growth in the late 1950's and early 1980's.

In contrast, the fitted parameters from Hamilton's model allow the "low" regime to fit "moderately low" growth rates that cover a wider range of recessions.

We can't compare these two models' outcomes using e.g. the log-likelihood values because they're using different datasets. One thing we could try, though is to use the fitted parameters from Hamilton's dataset on the updated GNP data. Doing that, we get the following result:

Model 3: Updated dataset using parameters estimated on Hamilton's dataset

Markov Switching Model Results

================================================================================

Dep. Variable: GNPC96 No. Observations: 131

Model: MarkovAutoregression Log Likelihood -191.807

Date: Sun, 02 Apr 2017 AIC 401.614

Time: 19:52:52 BIC 427.491

Sample: 04-01-1951 HQIC 412.129

- 10-01-1984

Covariance Type: opg

Regime 0 parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -0.3588 0.185 -1.939 0.053 -0.722 0.004

Regime 1 parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 1.1635 0.083 13.967 0.000 1.000 1.327

Non-switching parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

sigma2 0.5914 0.090 6.604 0.000 0.416 0.767

ar.L1 0.0135 0.100 0.134 0.893 -0.183 0.210

ar.L2 -0.0575 0.088 -0.651 0.515 -0.231 0.116

ar.L3 -0.2470 0.104 -2.384 0.017 -0.450 -0.044

ar.L4 -0.2129 0.084 -2.524 0.012 -0.378 -0.048

Regime transition parameters

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

p[0->0] 0.7547 0.100 7.563 0.000 0.559 0.950

p[1->0] 0.0959 0.051 1.872 0.061 -0.005 0.196

==============================================================================

This looks more like what you expected / wanted, and that's because as I mentioned above, the "low" regime intercept of 0.35 makes the "low" regime a good fit for more time periods in the sample. But notice that the log-likelihood here is -191.8, whereas in Model 2 the log-likelihood was -188.0.

Thus even though this model looks more like what you wanted, it does not fit the data as well.

(Note again that you can't compare these log-likelihoods to the -181.3 from Model 1, because that is using a different dataset).