I have not found any good answers on how to go about finding Support/Resistance levels in R. Essentially I would like clusters/areas or pivots where the stock is consolidating, but have found it difficult to do so.

# loads quatmod & xts

library("quantmod")

# Retrive 'ESSI' TICKER OHLCV data

STOCK = getSymbols("ESSI",auto.assign = FALSE)

# last observation carried formward / facilitates NAs

STOCK <- reclass(apply(STOCK,2,na.locf),match.to=STOCK)

# To be used as a rolling window

K=20

# Find MAX for Each Open, High, Low, Close Column & merge them

MAX <- merge.xts(rollmax(Op(STOCK), k=K, na.pad=TRUE),rollmax(Hi(STOCK), k=K, na.pad=TRUE),rollmax(Lo(STOCK), k=K, na.pad=TRUE),rollmax(Cl(STOCK), k=K, na.pad=TRUE))

# Find the mean of each MAX row

MAX <- na.locf(reclass(apply(MAX,1,mean),match.to=MAX))

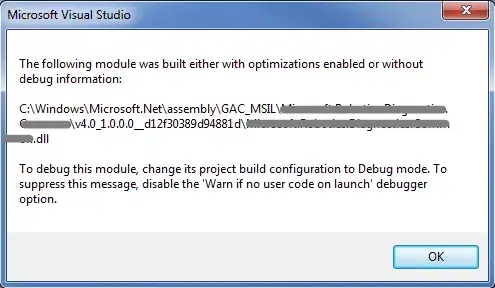

I would do the same for the Low's but I think I would be better off going about using DonchianChannel() but it is not what I want... The output should return something similar to FinViz's :