I am trading options, but I need to calculate the historical implied volatility in the last year. I am using Interactive Broker's TWS. Unfortunately they only calculate V30 (the implied volatility of the stock using options that will expire in 30 days). I need to calculate the implied volatility of the stock using options that will expire in 60 days, and 90 days.

The problem: Calculate the implied volatility of at least a whole year of an individual stock using options that will expire in 60 days and 90 days giving that:

- TWS does not provide V60 or V90.

- TWS does not provide historical pricing data for individual options for more than 3 months.

The attempted solution:

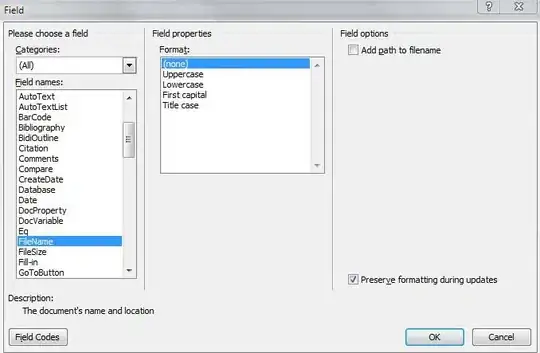

- Use the V30 that TWS provide too come up with V60 and V90 giving the fact that usually option prices will behave like a skew (horizontal skew). However, the problem to this attempted solution is that the skew does not always have a positive slope, so I can't come up with a mathematical solution to always correctly estimate IV60 and IV90 as this can have a positive or negative slope like in the picture below.

Any ideas?