I'm trying to maximize Sharpe's ratio using scipy.minimize

I do this for finding CAPM's Security Market Line

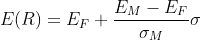

So I have an equation:

Optional (if short positions is not allowed):

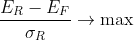

So I'm trying solve this:

def target_func(x, cov_matix, mean_vector, virtual_mean):

f = float(-(x.dot(mean_vector) - virtual_mean) / np.sqrt(x.dot(cov_matix).dot(x.T)))

return f

def optimal_portfolio_with_virtual_mean(profits, virtual_mean, allow_short=False):

x = np.zeros(len(profits))

mean_vector = np.mean(profits, axis=1)

cov_matrix = np.cov(profits)

cons = ({'type': 'eq',

'fun': lambda x: np.sum(x) - 1})

if not allow_short:

bounds = [(0, None,) for i in range(len(x))]

else:

bounds = None

minimize = optimize.minimize(target_func, x, args=(cov_matrix, mean_vector, virtual_mean,), bounds=bounds,

constraints=cons)

return minimize

But I always get Success: False (iteration limit exceeded). I tried to set maxiter = 10000 option, but it didn't help.

I will be greatful for any help

P.S. I use python 2.7