Q1: Solution

You might have already noticed, that your FxMarketEVENTs data will in principle never match the condition:

Bid < DayOpen - StopLossLevel

The anatomy of calculus is following:

/* ----------------------------------------------------------------------------

...............dHIGH[1] ~ 1.22ooo

|

| ....... dHIGH[0] ~ 1.2oooo

| |

dOPEN[0]...|..... | ~ 1.18ooo

[ ] [ ]

[ ] [ ]

[ ] [ ]______ dCLOSE[0] _______________ <Bid> ~ 1.12345 _________

[ ] |

[ ] |

dOPEN[1] _[ ] | ..... dLOW[0] ~ 1.1oooo

|

|

| ............. dLOW[1]

------------------------------------------------------------------------------ */

StopLossLevel = Bid - Point * StopLoss;

// -------------

// StopLossLevel ~ 1.12345 - 0.00010;

// StopLossLevel ~ 1.12335;

if ( Bid < DayOpen - StopLossLevel ){...}

if ( 1.12345 < 1.10000 - 1.12335 ){...}

if ( 1.12345 < -0.02335 ){...} // which it NEVER could be

Comparing numbers and using PriceDOMAIN values in XTO requires a bit more care in MQL4.

A good programming practice for safe MQL4 code-execution recommends:

// StopLossLevel = Bid - ( _Point * StopLoss ); Calculus-safe

// StopLossLevel = NormalizeDouble( Bid - ( _Point * StopLoss ),

// _Digits XTO-safe

);

Epilogue

Q2 has been covered in another answer.

Adding a few cents here, to the reasoning provided there, the profitability is heavily dependent on many attributes.

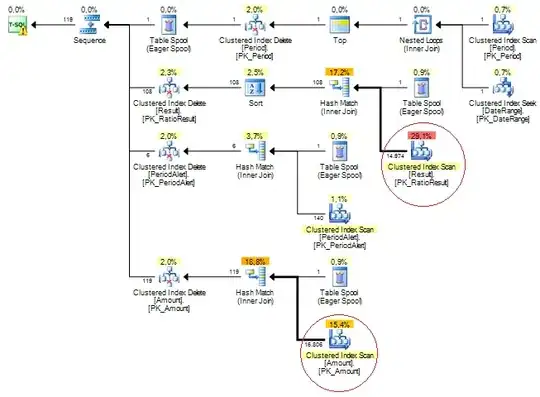

So as to illustrate the industry experience, let me present you a view into a sensitivity of profit, visually reduced into a single-dimension graph:

You may observe configurations of the very same algorithm to provide yields of about +1500% profits altogether with settings, that do not allow to produce, with the very same behaviour, more than about +20% .. +80%.

It is common to have pretty high-dimensionality parametrisation spaces in quant-modelling, which do not have any simple projection into 2D, 3D, 4D or 5D display-able graphics.

Thus, without thorough quantitative data, any statement about any strategy profitability is, paraphrased the famous Deming quote, "just another opinion".