I am running the latest WordPress with the latest WooCommerce, as of this writing.

I have one standard tax rule setup for 20%. This is UK VAT.

I have a product setup at £350. 20% of 350 should be 280.

20 x 350 / 100 = 70

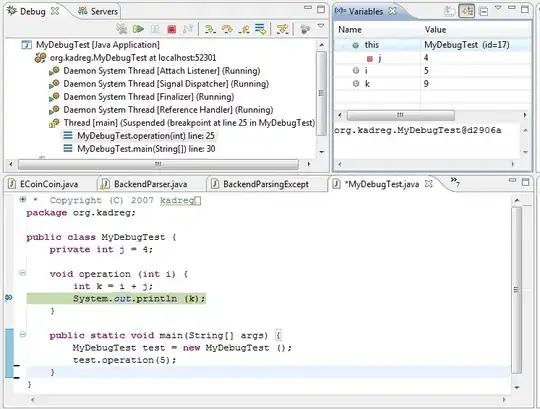

However, on my product page AND checkout basket etc, the amount comes to: 291.67 (ex Tax). This should be 280. This is really wrong! So I'm not sure it's related to how I am coding the output of the product page, since I haven't touched the checkout template at all.

I am not sure if I have set something up incorrectly? Why am I getting such an odd number.

Some rules I have setup:

- Yes, I will enter prices inclusive of tax.

- Display prices during cart/checkout: Excluding tax.

- Shipping tax class: Shipping tax class based on cart items.

I really cannot work this one out.

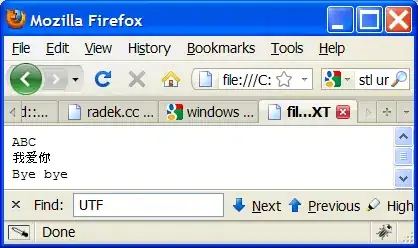

The tax setup:

The tax on the checkout:

Any help greatly appreciated!

Thanks, Mikey