Everyone gets Richer.

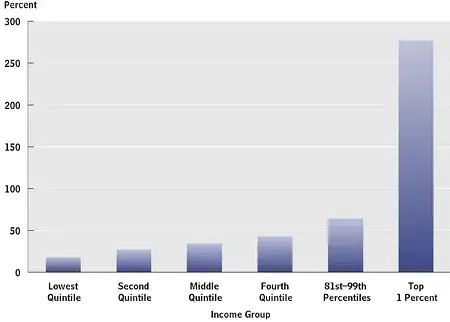

Growth in Real After-Tax Income from 1979-2007

CBO finds that, between 1979 and 2007, income grew by:

275 percent for the top 1 percent of households,

65 percent for the next 19 percent,

Just under 40 percent for the next 60 percent, and

18 percent for the bottom 20 percent.

But, you might say that the "gap" increased. Unfortunately, these numbers don't take into account individual people who might be rich, they only look at the group as a whole. The people who make up that group change over time. If you are rich/poor one year, it doesn't follow that you will continue to be so the next year.

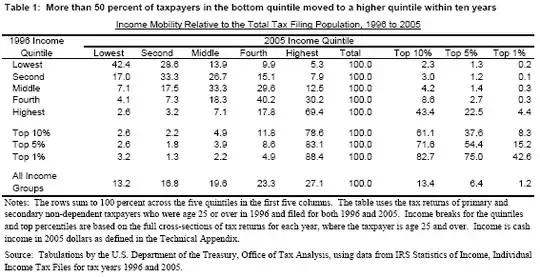

It isn't true of individuals over time.

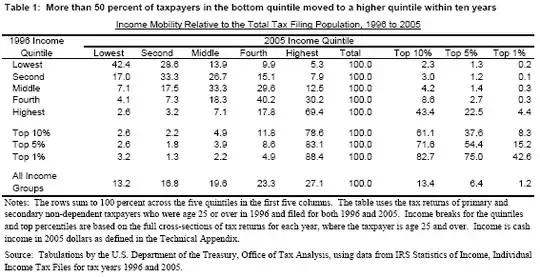

The table shows a high degree of income mobility over this period. Nearly 58 percent of households (i.e., 57.6 = 100 – 42.4) in the lowest income quintile in 1996 had moved to a higher quintile by 2005.

Middle-income taxpayers also did well with respect to mobility across income quintiles in the population. A much larger portion moved up to a higher income quintile (42.1 percent = 29.6 +12.5) than dropped to a lower quintile (24.6 percent = 7.1 +17.5).

The mobility of the top 1 percent of the income distribution is also important. More than half (57.4 percent = 100 – 42.6) of the top 1 percent of households in 1996 had dropped to a lower income group by 2005

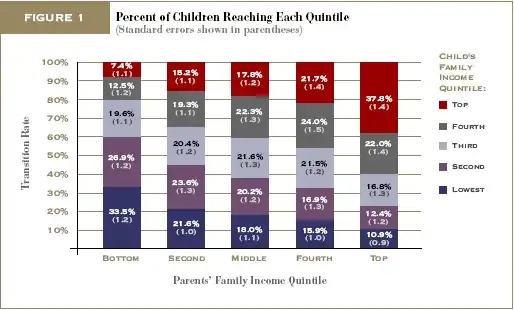

It isn't true between generations.

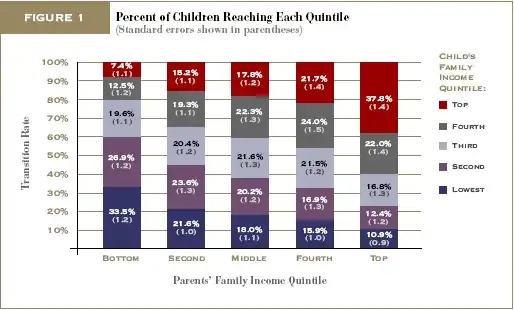

Since the transition rates in Figure 1 showed that 33.5 percent remained in the bottom quintile, that implies that 66.5 percent (100 – 33.5 = 66.5) exceeded the bottom quintile, as shown in Table 1.

... 38 percent of those whose parents were in the top income quintile remain in the top quintile.