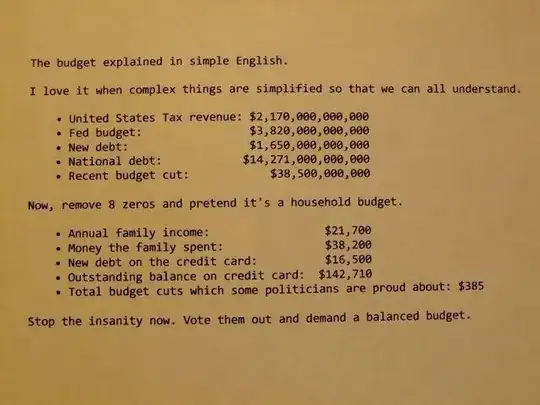

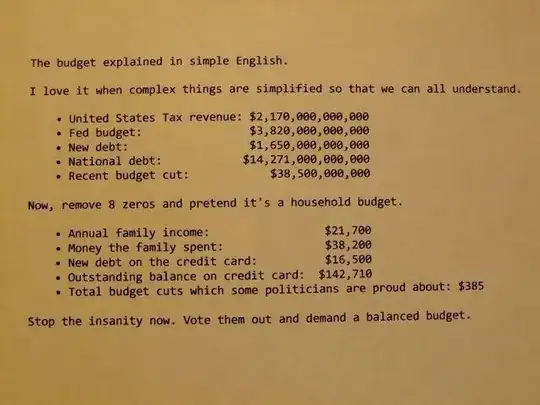

I've seen this image doing the rounds on Facebook, etc:

I'm dubious out these figures. Is this an over-simplification? Can you use those figures in the same calculation?

I've seen this image doing the rounds on Facebook, etc:

I'm dubious out these figures. Is this an over-simplification? Can you use those figures in the same calculation?

Is this an over-simplification?

First, families have to pay back their debt. Governments don’t — all they need to do is ensure that debt grows more slowly than their tax base. The debt from World War II was never repaid; it just became increasingly irrelevant as the U.S. economy grew, and with it the income subject to taxation.

- Paul Krugman, Nobody Understands Debt

Second...

Whenever a demagogue wants to whip up hysteria about federal budget deficits, he or she invariably begins with an analogy to a household’s budget: “No household can continually spend more than its income, and neither can the federal government”. On the surface that, might appear sensible; dig deeper and it makes no sense at all. A sovereign government bears no obvious resemblance to a household.

- L. Randall Wray, The Federal Budget is NOT like a Household Budget: Here’s Why

Summary of points (from the source above)

The US federal government is 221 years old, if we date its birth to the adoption of the Constitution.

With one brief exception, the federal government has been in debt every year since 1776.

The United States has also experienced six periods of depression.

The federal government is the issuer of our currency.

Some claim that if the government continues to run deficits, some day the dollar’s value will fall due to inflation; or its value will depreciate relative to foreign currencies.

If the speaker claims that government budget deficits are unsustainable, that government must eventually pay back all that debt, ask him or her why we have managed to avoid retiring debt since 1837.

I can think of nothing more fundamentally foolish, more unequivocally self-destructive to our economic well being today than attempting to balance the US federal budget. It is totally unnecessary and every dollar we cut from government spending is a dollar taken from someone’s income. That we should be so enthusiastically pursuing such a policy when there are almost 14 million unemployed workers is mind boggling. How is further lowering the effective demand for goods and services supposed to help? It cannot, of course, and will only serve to make things worse – much, much worse. - John T. Harvey, How to Destroy the US Economy? Balance the Budget

*Ok, voting them out might not be such a bad idea.

Remove banking regulations by passing the Gramm–Leach–Bliley Act of 1999 and allow the creation of giant financial supermarkets that could own investment banks, commercial banks and insurance firms, something banned since the Great Depression (see Glass-Steagall Act of 1933).

Basically, allow investment banking firms to gamble with their depositors' money and drive the economy into crapper by 2007. Not smart.

The numbers aren't quite the same for the year I could find data, but the overall story is correct. According to the GAO's Financial Statements of the United States Government for the Years Ended September 30, 2010, and 2009, the figures would be:

Income: 2.2T

Net Cost: 4.3T

Net Operating Cost: (2.1T)

Net Position: (13.5T)

Is it an oversimplification to compare the Federal budget to a family budget? Definitely. Federal obligations are much more complicated than that of a family, Federal borrowing costs much less than credit cards, Federal income growth (and volatility) is very different than typical wages, etc.

The overall comparison for income, expenses, and deficit are correct:

2011 Income: $2,400 Billion

2011 Expense: $3,700 Billion

2011 New Debt: $1,300 Billion

Total Debt: $16,000 Billion

To say the $16,000 billion in debt is like credit card is not an accurate comparison.

Of the $16,000 billion in debt, approximately $10,200 billion is held by the public and $5,800 billion is held by other government agencies.

The $5,800 billion that is held by other government agencies is debt that was purchased mainly by the social security trust fund. For most of its existence the social security trust fund ran a surplus (that ended in March of 2011 when the first boomers started to retire. Since then the fund has been sending out more payments then it has been taking in). This surplus allowed the fund to pile up an excess of $2.5 trillion. The fund was required to purchase government bonds with the excess. This allowed the US government to spend the money in the trust fund. This is similar to borrowing from you retirement account in order to spend the money now. All that sits in the trust fund now is $2.5 trillion in US government bonds.

The argument is frequently made for this type of debt: "we owe it to ourselves". This always makes me chuckle. The US government owes the social security trust fund $2.5 trillion. I'm not the US government so don't count me in the "we" part of "we owe it to ourselves". I'm also fairly certain I will never see a dime of social security so don't count me in the "ourselves" portion either.

The remaining $10,200 billion that is held by the public is mainly short term debt. Around 83% of the public debt is held in bonds that mature in less than 10 years. This means the US government is more exposed to interest rate moves since it is continually rolling over short term debt and issuing new debt at the prevailing interest rates. This makes this debt closer to a very large adjustable rate mortgage.

It seems that another reason this is a bad analogy is that, "America owes foreigners about $4.5 trillion in debt. But America owes America $9.8 trillion."

http://globalpublicsquare.blogs.cnn.com/2011/07/21/who-owns-america-hint-its-not-china/

The breakdown:

Hong Kong: $121.9 billion (0.9 percent)

Caribbean banking centers: $148.3 (1 percent)

Taiwan: $153.4 billion (1.1 percent)

Brazil: $211.4 billion (1.5 percent)

Oil exporting countries: $229.8 billion (1.6 percent)

Mutual funds: $300.5 billion (2 percent)

Commercial banks: $301.8 billion (2.1 percent)

State, local and federal retirement funds: $320.9 billion (2.2 percent)

Money market mutual funds: $337.7 billion (2.4 percent)

United Kingdom: $346.5 billion (2.4 percent)

Private pension funds: $504.7 billion (3.5 percent)

State and local governments: $506.1 billion (3.5 percent)

Japan: $912.4 billion (6.4 percent)

U.S. households: $959.4 billion (6.6 percent)

China: $1.16 trillion (8 percent)

The U.S. Treasury: $1.63 trillion (11.3 percent)

Social Security trust fund: $2.67 trillion (19 percent)

Since the claim is being put in simple terms, I'll attempt to provide an answer in simple terms.

A household has a fixed monthly income. No matter how much you cut back on your expenditure, you get paid the same wage every month. If you spend a lot more than you earn there is little prospect of you being able to pay it back, because your wages won't rise fast enough and eventually you will either die or declare bankruptcy.

A government has a variable income. The amount of tax it gets varies depending on how well the economy is doing. If unemployment is high then fewer people are paying income tax and they have less money to spend so there is less consumption tax too. If businesses go bust or cut back their activities then business tax revenues fall. This is called recession. Conversely, when times are good tax revenue goes up as well.

When an individual is spending more than they earn, they can either cut back or try to earn more. Since the latter is difficult, especially in a recession, they usually choose the former.

Many governments favour growing the economy out of recession. This can take many forms, from printing money to investing or cutting taxes. They all aim to stimulate business activity. There are alternative schools of though, but they tend to lead to problem's like Japan's lost decade (which is more like 20 years) or the current problems in the UK and other EU countries like Spain and Greece. While there may eventually be a correction, many people suffer poverty in the mean time.

Essentially, what the image is suggesting is the second option. Stop stimulating the economy and instead cut back on government economic activity. Given that a deficit of economic activity is the definition of a recession, it is hopefully obvious why that is a bad idea, and why the spending outlined is not insane and you should not demand a balanced budget.

Other answers have pointed out how government debt is not treated the same way as household debt, so I will not cover that aspect.