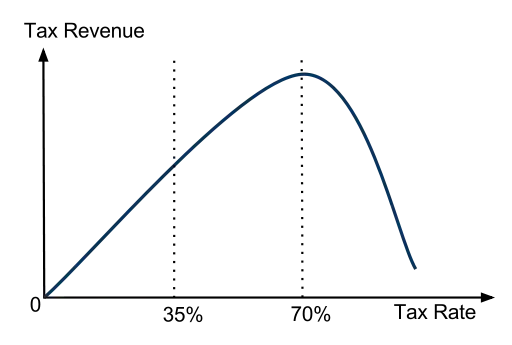

I often see/hear this argument used as an argument against raising income tax, at least here in the UK. The argument being the rich will leave, taking their cash out of the country, resulting in damage to the economy.

I am always slightly sceptical about this argument. Have there been any documented cases of tax rises resulting in wealthier citizens leaving for places with lower taxes, in such numbers that the economy was harmed?

NOTE: I'm not talking about business tax here, I'm specifically talking about income tax.

A few references to this claim:

- http://www.nationalreview.com/articles/277249/you-can-t-tax-rich-thomas-sowell

- http://www.politicalforum.com/political-opinions-beliefs/193114-will-raising-taxes-cause-rich-leave-united-states-they-bluffing-3.html

- http://answers.yahoo.com/question/index?qid=20110530093031AA53cpp

- http://savingmoneytoday.net/would-you-ever-leave-the-us-if-taxes-got-too-high/

Some of the these articles claim evidence for this effect, but I have no way to judge the veracity or validity of this evidence.