In The solution to income disparity? Consumption taxes, Timothy Taylor claims the following:

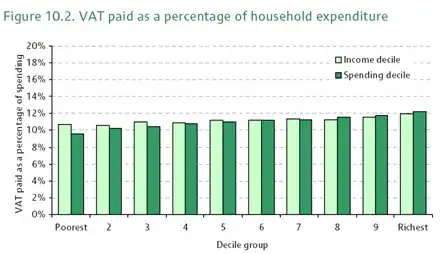

Why are VATs and sales taxes so unpopular? One common critique is that they are regressive. ... But if you measure a VAT or sales tax relative to total spending by individuals—the rich generally spend a lot more than the poor—those taxes actually look progressive.

The argument that higher value-added taxes is a great solution to income inequality, because it can fund cash transfers to the less fortunate, is hardly new to me. However, it is the first time I read that VATs may naturally be progressive, even without any cash transfer to the poor.

Is there any literature backing his claim?