Who would really be paying for the proposed property tax cuts that the state of Texas is considering?

Texas taxpayers, via the state of Texas, but more evenly than they would have otherwise.

tl;dr: Texas has a complex system of cost sharing between state and local governments which attempts to smooth out changes in property taxes between districts with rising and falling property values. The idea is to keep a rapidly growing district's property taxes from skyrocketing, and a rapidly shrinking district from over-taxing. By making up the difference using state money, the cost of these local changes is shared throughout the whole state.

That's the best I can figure out.

Property taxes in Texas.

From the Texas Comptroller's Property Tax Basics...

Property taxes provide the largest source of money that local governments use to pay for schools, streets, roads, police, fire protection and many other services. Texas law establishes the process followed by local officials in determining the property's value, ensuring that values are equal and uniform, setting tax rates and collecting taxes.

Texas has no state property tax. [emphasis theirs] The Texas Constitution and statutory law authorizes local governments to collect the tax. The state does not set tax rates, collect taxes or settle disputes between you and your local governments.

Given that, I think the real questions are...

- If Texas has no state property tax, how can the state claim to be lowering property taxes?

- If Texas lowers its property taxes, how will they fund their "schools, streets, roads, police, fire protection and many other services"?

How is the state lowering local property taxes?

The state of Texas has a lot of limits on how local governments can set their property taxes. In this case it appears they're proposing to raise the "homestead exception" from $40,000 to $70,000. The Texas Comptroller explains...

You may apply for homestead exemptions on your principal residence. Homestead exemptions remove part of your home's value from taxation, so they lower your taxes.

For example, your home is appraised at $300,000, and you qualify for a $40,000 exemption (this is the amount mandated for school districts), you will pay school taxes on the home as if it was worth only $260,000. Taxing units have the option to offer an additional exemption of up to 20 percent of the total value.

There are several types of exemptions you may receive.

School taxes: All residence homestead owners are allowed a $40,000 residence homestead exemption from their home's value for school taxes.

County taxes: If a county collects a special tax for farm-to-market roads or flood control, a residence homestead is allowed to receive a $3,000 exemption for this tax. If the county grants an optional exemption for homeowners age 65 or older or disabled, the owners will receive only the local-option exemption.

...and so on.

How will local governments pay for things?

If there's less property value to tax, won't this lead to less revenue for local governments? How will they pay for things?

tl;dr: The state helps pay the difference. They're using the state budget surplus to help pay for local governments. Local governments lower their property taxes, the state makes up the funding shortfall.

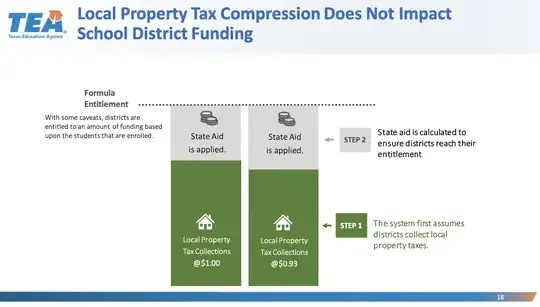

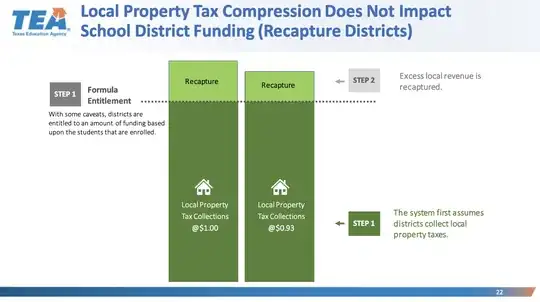

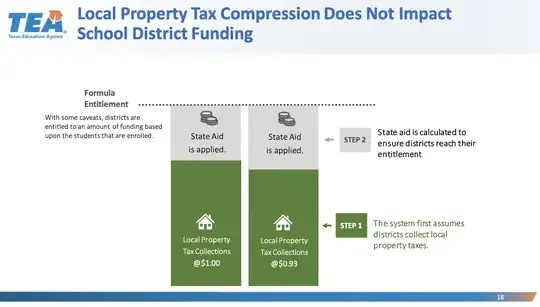

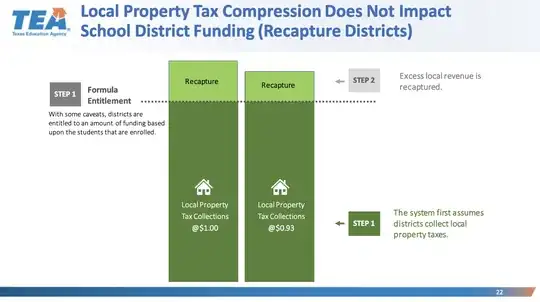

This is all way over my head, but it seems to boil down to...

- The state decides how much local funding is needed

- If there is a shortfall in local tax collection, the state makes up the difference.

- If there is a surplus in local tax collection, the state "recaptures" the difference.

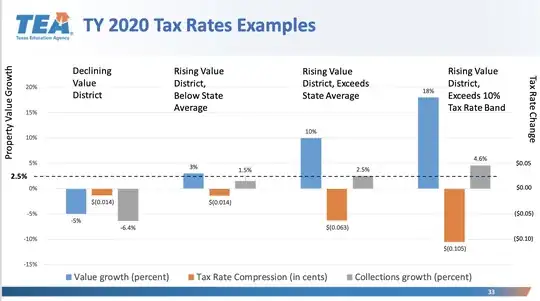

The best document I've found to explain all this is the Texas Education Agency's presentation "HB 3 in 30: Tax Compression Part 2, Setting Your District's 2020 M&O Tax Rate". Here's some relevant slides.

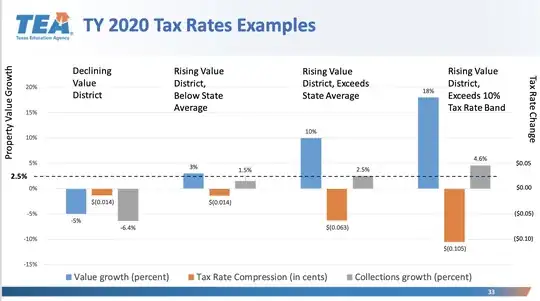

The intent seems to be to smooth out increases in property tax increases in rapidly growing districts, and overtaxing in others.

Districts which grow faster than the statewide average growth rate will

benefit from having their tax rates compressed further so that the district’s

local tax collections only increase by 2.5% year over year.

("Collections Growth", the grey bar, is how much that district may increase or decrease property taxes)

HB 3 heavily revised how property taxes in Texas worked in 2019. The following is from the Fiscal Note on HB3...

The bill would reduce recapture paid by local school districts by an estimated $3.5 billion in the upcoming biennium. The bill would have the effect of compressing local maintenance and operations property tax rates, and would reduce local property tax collections by a total of $2.7 billion in the 2020-21 biennium. This decrease in local maintenance and operations property tax collections would be partially offset by an increase in state aid related to the compression of local maintenance and operations tax rates. In subsequent years, ongoing tax compression would continue to decrease tax revenue collections.

Under the provisions of the bill, additional state aid would be provided to school districts and charter schools relative to current law for fiscal years 2020 and 2021. Districts whose entitlement would be less under the provisions of the bill as compared to current law would be eligible for a formula transition grant through fiscal year 2024. To the extent that districts incurred additional costs detailed below, increases in entitlement could be used to offset any potential costs.

The bill would result in local school district and charter school costs for both retirement and health benefits provided by TRS. The additional state aid provided to districts and charters is assumed to cover these costs, through the teacher incentive allotment or other increases in Foundation School Program entitlement.