This broadcast ...

... says:

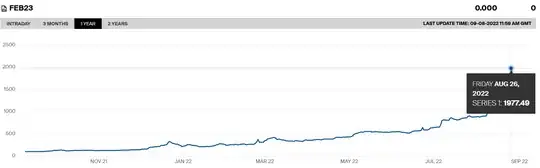

The wholesale price for 2022 was €85 per MWh and the price for 2023 has gone up to over €1000.

Is that true? That is a pretty big jump.

Is it comparing like-to-like -- or is that comparing apples-to-oranges? For example was €85 an average price whereas €1000 is something else, perhaps a marginal price or a price during peak demand?

I note that 2023 doesn't exist yet so I guess that €1000 is some kind of "futures" price? Is there much trade now happening at that price, or does it just mean that no seller currently wants to guarantee a future price, so they're asking a sky-is-the-limit amount that very few would actually buy at?