British energy company Octopus Energy claims on their blog:

If we keep burning fossil fuels at our current rate, it is generally estimated that all our fossil fuels will be depleted by 2060.

This doesn't seem very far away. Is this true?

British energy company Octopus Energy claims on their blog:

If we keep burning fossil fuels at our current rate, it is generally estimated that all our fossil fuels will be depleted by 2060.

This doesn't seem very far away. Is this true?

No

First, this figure is for petroleum. For coal, the figure is much larger. Some of the figures I found for coal were 133 years, "anywhere from 68 years to a hundreds of years", and 357 years (in that last one, "we" may be referring to just the US).

Second, this number is for proven oil reserves. Proven oil reserves is oil that is

(1) known

and can be extracted

(2) at current market prices

(3) with current technology.

More deposits being found, oil prices increasing, and better extraction technology can all increase the amount of proven oil reserves.

According to Forbes, only about a third of oil is extracted. This would give another century in current oil reserves, plus all the oil left over from past reservoirs:

And beyond just crude oil, which is about 83% of total supply, there is a rapidly expanding stockpile of biofuels, natural gas liquids, synthetic fuels, and other sources that will continue to broaden the availability of liquid fuels. Additionally, ~66% of the oil in a reservoir is frequently left behind because it's too expensive or difficult to extract.

Some of this is not practical to recover for any reasonable price. Just how much is "left" is much fuzzier than it might seem at first glance, but it's certainly more than the forty years that Octopus Energy claims.

For oil, using proven reserves and current oil production, the date is more like 2067. World proven reserves are approximately 1.7 trillion barrels, or 1.7 million-million barrels (EIA figures]). Current rate of production is about 100 million barrels/day, (EIA figures). The 100mb/d rate will eat through the 1.8 trillion barrel reserves in about 47 years.

For natural gas it is about 2073; again using EIA numbers for reserves (7,300 trillion cf) and production (140 trillion cf/year).

For coal the IEA numbers yield an estimate of 2150 (reserves: 1.16 million-million short tons, production: 8,800 million short tons/year); again using the current production vs. known reserves benchmark.

The oil specific quote from the linked article states:

Different fossil fuels have different depletion dates. In 2018, the demand for oil rose by 1.3% - which is almost double the average annual rate seen over the 10 years prior. With demand predominately driven by the transport sector, our oil reserves are running out faster than our other fossil fuels. In fact, if we don’t find any additional oil reserves, it’s estimated that our known oil deposits will be gone by 2052.

Similar language is used to describe their assumptions for the other fossil fuels. Thus, the figures above are an apples-to-apples comparison with the assumptions used in the article.

Also note this overall disclaimer in the article:

The answer isn’t exactly straightforward. Different sources have given different estimates, with no universally agreed timeframe. There are lots of different factors that need to be taken into account, such as which fossil fuel we’re looking at, our current and future usage levels, and whether we discover any more reserves.

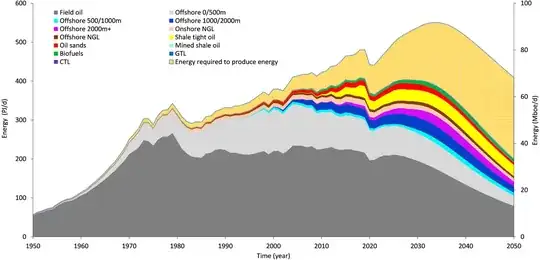

On current trends, we won't run out of fossil fuels, even oil or gas.

This is a slightly misleading statement because the question asks about the current burn rate, and this answer rephrases to "current trends", which requires justification. It's a demand side argument; "current burn rate" ignores that demand is (or soon will be) a fast moving target.

Rather than justify the argument (which was deprecated here as "original research" and then "common sense or pure logic") just refer to a recent study from Oxford University illustrating the current trend in energy prices and how the economics make it unlikely that the current burn rate will be maintained

Basic economics must dictate the trend from there : oil is fundamentally a depreciating asset, and any oil company executives must, deep down, be painfully aware of that fact. (Notably, in recent years the Saudi royal family floated Aramco, i.e. partially divested themselves from it : note though that attributing this to future depreciation is my speculation)

EDIT : Since the original answer, Nature has published an article discussing this reframing of the question

While reading the other answers, you might get the impression that fossil fuel availability won't be a problem for 100 years.

Unextractable oil, fossil methane gas and coal reserves are estimated as the percentage of the 2018 reserve base that is not extracted to achieve a 50% probability of keeping the global temperature increase to 1.5 °C. We estimate this to be 58% for oil, 59% for fossil methane gas and 89% for coal in 2050. This means that very high shares of reserves considered economic today would not be extracted under a global 1.5 °C target.

It means that:

We will have to switch someday, and the sooner the better. Business as usual for over 50 years (see "Reserves-to-production ratio" in "BP statistical review of world energy"), with 84% of our energy coming from fossil fuels, would render some of the world’s most densely populated areas inhabitable.