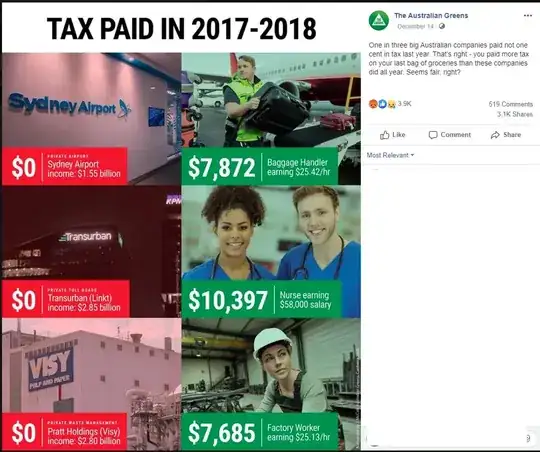

On December 14, 2019, the Australian Greens posted a claim to their Facebook feed about taxes paid by individuals and various entities.

The claim is in the image on this page, but essentially the claims are:

That the following organisations paid 0 tax:

- Sydney airport

- Transurban

- Pratt holding visy recycling

These types of people paid tax:

- Baggage handler: $7,872

- Nurse earning $58,000 paid $10,397

- Factory worker: $7,685