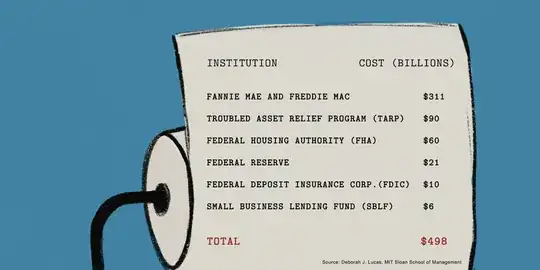

This site here says that basically, the government sold back some of the assets it bought to bail-out banks during the financial crisis of '08.

I'm assuming it was basically the federal bank that financed this bail-out, which we can see essentially get filled with mortgage backed securities here.

I would think that if US Gvt did indeed get money from the bail-outs, the sheet would have been reduced to less than before?

Is this an artifact of inflation?