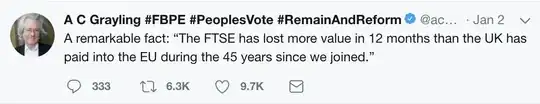

"Is this claim accurate?" Likely No, but also likely close to that.

The Guardian, emphasis mine:

The FTSE 100 tumbled by 12.5% during 2018, its biggest annual decline since 2008, wiping out more than £240bn of shareholder value.

According to the Daily Mail, Vote Leave has claimed (in 2015) that (emphasis mine)...

Britain has handed £503 BILLION to the EU since 1973...

However, that number is inflated. Vote Leave went on to claim that (emphasis mine)...

Annual contributions have increased from £187 million 43 years ago to a staggering £19 billion today.

The Office for National Statistics clarifies that this is not the whole truth (emphasis mine):

In 2016, the UK’s gross contribution to the EU amounted to £19 billion. However, this amount of money was never actually transferred to the EU. [...] Before the UK government transfers any money to the EU a rebate is applied. In 2016, the UK received a rebate of £5 billion. This means £13.9 billion was transferred from the UK government to the EU in official payments.

The ONS then goes on to point out that a significant portion of those payments flows back into the UK economy as it...

...is credited back to the UK public sector, of which a proportion is then paid to the private sector.

This further reduces the net payment.

We can safely assume that the £503bn total given by Vote Leave was inflated in the same way as the yearly number of £19bn was.

So while Vote Leave gave a number of gross EU payments that was twice that of The Guardian's number of FTSE 100 loss for 2018, the real net amount would be significantly less than that, but still probably more than the FTSE 100 loss. The orders of magnitude match up, the rest is financial number twisting.

"What does this mean?"

It means that the shareholder value of the 100 most important UK companies has diminished by that much.

The claim is that market proceedings in 2018 have damaged the UK economy more than 45 years of EU payments ever did.

Note that this does not take into account indirect effects, like access to the EU market, right to travel freely etc.

(An earlier edition of this answer stated somewhat hastily that the implied claim included that the losses were due to Brexit itself; I don't think this is the case, especially since e.g. German DAX or US Dow Jones showed similar trends. I think Mr. Grayling merely wanted to put things into perspective in global terms.)

"Is this unusual or is this within normal market fluctuations?"

It is not unprecedented. To repeat the Guardian quote with different emphasis (emphasis mine):

The FTSE 100 tumbled by 12.5% during 2018, its biggest annual decline since 2008...

For comparison, let me quote numbers from an article by The Telegraph:

In 2008 (subprime mortgage / banking crisis), the FTSE lost 31%.

In 2002 (dotcom crisis), the FTSE lost almost 25%.

In 2001 (9/11), the FTSE lost 16.2%.

So, while negative trends like this happened before, and I would say they are uncomfortably common in recent years, I would also say they are definitely not "usual". YMMV.