No, the article does NOT say that unions "will" be getting $22M as a fact. Quoting from the main article blurb (whatever you call those large-font quotes in middle of the article that are most important points):

IF THIS RATE OF GROWTH CONTINUES OVER THE NEXT TEN YEARS, INDUSTRY FUNDS WILL BE PAYING UNIONS $22 MILLION A YEAR BY 2027.

So, what the article claims is that the growth projection, if things remain unchanged, is $22M. Whether their projection analysis is accurate is a separate question (I wasn't able to find any independent analysis, and doing the analysis myself is off topic for Skeptics - you may want to ask on Finance or Economics or Statistics SE - it looks legit enough approximation to me to at least be in the right ballpark).

As far as the claim you didn't ask about (whether the money was paid) the original source of the claim is "Board fees for unionists cost industry super funds $5.4m" article by Elizabeth Colman in The Australian newspaper, though due to paywall, I read the article's re-print here:

Unions have reaped $5.4 million from industry super funds over the past two years by giving high-ranking officials spots on governance boards, in a practice slammed as “undesirable” by one of the nation’s leading financial experts.

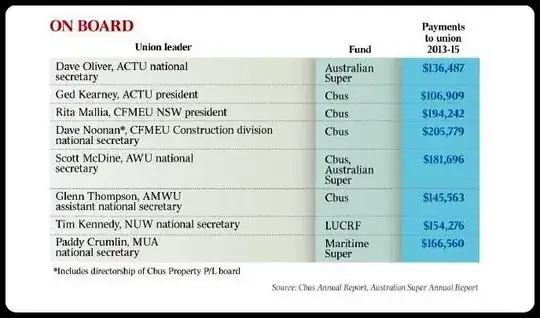

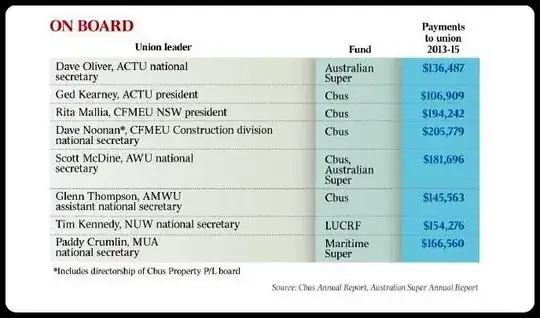

The ACTU, Construction Forestry Mining and Energy Union, Australian Workers Union and the Maritime Union of Australia were among those paid by Australia’s biggest industry super funds through non-executive directorships for prominent officials, fund records revealed.

Construction industry fund CBUS delivered the biggest payday of $927,940 to the CFMEU, the AMWU manufacturing workers union, the CEPU communications union and the ACTU in 2014-15.

Coalition plans to bolster independence on the boards of industry super funds were defeated this month after an ACTU campaign swayed key crossbenchers ahead of a Senate vote.

But The Australian’s analysis of fund records shows CBUS paid the ACTU $106,909 from members’ funds for president Ged Kearney to attend board meetings. The nation’s biggest super fund, Australian Super, paid $800,000 to five unions, including $136,487 to the ACTU for Dave Oliver’s spot on the board.

CBUS also paid $205,779 to the CFMEU for construction union national secretary Dave Noonan to attend board meetings over the past two years.

The source of data seems to be annual reports, the article has a table sourced from CBUS annual report