Mostly false.

According to Wikipedia, List of countries by tax rates, Belgium has the highest maximum income tax rate (64% tax), Cameroon has the highest corporate tax rate (38.5%) and Netherlands have the highest minimum income tax rate (36.55%).

Time.com reported in Jul 19, 2017:

As the Republicans in Washington prepare to dig into the coming round of budget negotiations, their top priorities will include an systemic overhaul for U.S. taxes, which President Trump has characterized as "just about the highest in the world."

But how much do Americans really pay compared with other nations? It may be less than you think.

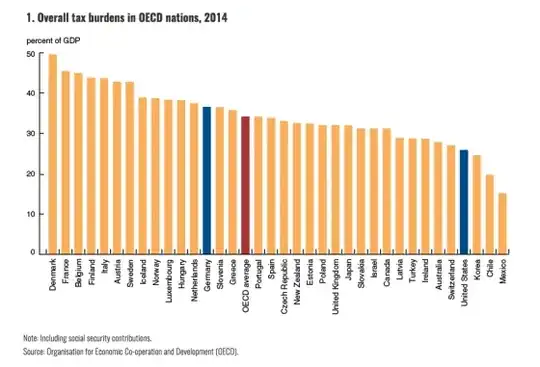

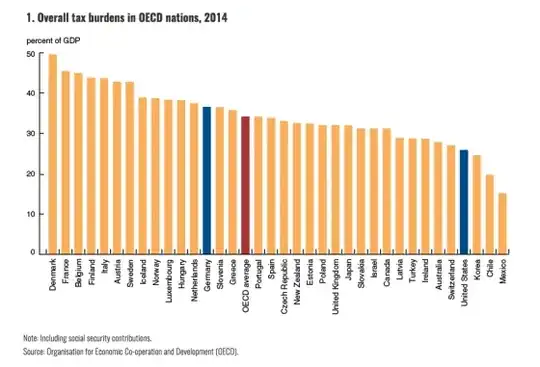

A research paper published this week by the Federal Reserve Bank of Chicago includes the above chart, highlighting the tax burdens of all 35 OECD countries as of 2014. With a tax burden of 25% -- a measurement that includes income, property, and various other taxes -- the U.S. is near the very bottom, well below the overall average of 34%. It ranks below all the measured countries except Korea, Chile, and Mexico.

Trump and other Republicans are right about one aspect of U.S. taxes, however. When it comes to taxing corporate profits, the U.S. does indeed have one of the highest nominal maximum rates in the world, at 35%.

The highest corporate tax rate is 38.5% (Cameroon) which is 3.5% higher than the US rate. But some states in the US have extra state based corporate tax of 1-12%.

The [US] marginal federal corporate income tax rate on the highest income bracket of corporations (currently above USD 18,333,333) is 35%. State and local governments may also impose income taxes ranging from 0% to 12%, the top marginal rates averaging approximately 7.5%. - Kpmg

So, US states that have local corporate tax above 3.5%, the rate is 38.5%+ and therefore higher than any other coutry in the world. But that doesn't apply to all state.

He would be right to say "some of our states have the highest corporate tax rates in the world."