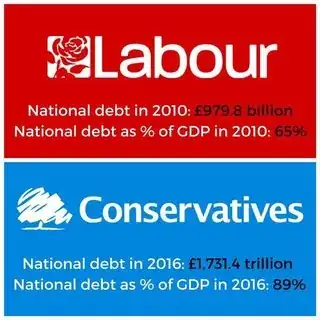

I saw this image being shared on my Facebook feed, and I was wondering the truth (if any) to it.

I saw this image being shared on my Facebook feed, and I was wondering the truth (if any) to it.

The debt figures as a proportion of GDP appear to be correct according to the Office of National Statistics, which can be considered the official source.

(Thanks @Henry for helping with the upload.)

(Thanks @Henry for helping with the upload.)

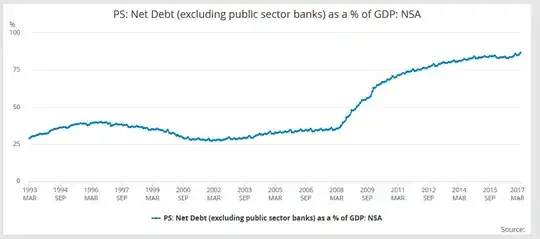

However, the national debt appears to start rising rapidly in early 2008 under a Labour government (presumably in response to the 2007-8 Global Financial Crisis), when it was 35%, and has been rising at a lower rate since 2010 under the Conservatives, so it is at the same time a bit disingenuous in my opinion, plus ca change...

This is the chart from the Office for National Statistics Dikran Marsupial may have been trying to upload:

It gives numbers of

For values an equivalent chart is

with values

so close to but not the same as your Facebook images

The image gives a value for 2010 of £979.8 billion, and a value for 2016 of £1,731.4 trillion. One trillion* (1,000,000,000,000) is one thousand billion, so rather than the 2016 value being roughly 1.7 times that of 2010 (Dikran Marsupial and Henry's answers seem to suggest this is largely accurate), it's actually saying that the UK's national debt has increased by more than a thousandfold.

As ever, relevant on XKCD.

*Assuming short scale, which the UK uses - see Long and short scales (Wikipedia).

Yes, the debt has increased, but the annual deficit has been reduced. See this page for an historical view.