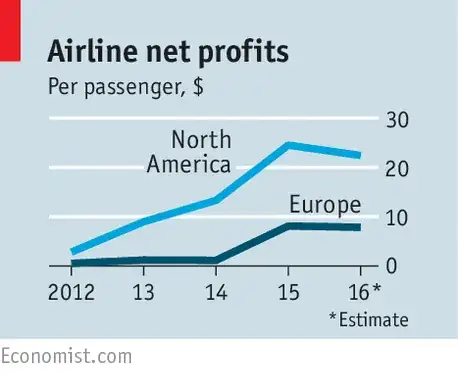

A quick google search returns several articles such as this one claiming that airlines make less than $10 in profit from each customer.

I feel there are a few reasons to doubt this premise:

You can connect through some destinations more cheaply than landing there

Skiplagged is a service helps users find cheaper airfare by booking flights that connect through their actual intended destinations to ones that are less popular and therefore are being sold more cheaply. Users are then expected to simply intentionally miss their final connection.

This means that a travel agency or airline can book seats on more planes and sell that connecting flight for less money. If the airlines have very small profit margins, then that proposition wouldn't just return less profit; it would lose money.

Ticket prices are higher in recent years

After 30 years of gradual decline due to competition, prices have been increasing since 2010 and have returned to levels they were at before the 'great recession'.

Rising prices are contrasted by apparent decreasing costs

- Fuel prices have come down since spiking in 2010

- Pilots work long hours and in some cases for surprisingly low pay

- There's less leg room than ever due to cramming more seats on each plane

- Meals and other niceties common in the 90's have disappeared from most flights

- Many flights now don't have screens to watch movies on or ports to connect earphones to; customers connect their devices to the entertainment system via wifi

So, is the claim that airlines turn $10 profit per customer accurate?