As originally adopted, the constitution of the United States, Article I, section 2 read (in part):

Representatives and direct Taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers, which shall be determined by adding to the whole Number of free Persons, including those bound to Service for a Term of Years, and excluding Indians not taxed, three fifths of all other Persons.

Article I, section 8 read (in part):

The Congress shall have Power To lay and collect Taxes

and Article I, section 9, read (in part):

No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or Enumeration herein before directed to be taken.

In other words, taxation of earnings by the federal government was permitted, but for direct taxes (a disputed term eventually held by court to mean taxes on property or assets, see below) applying a single tax policy to each person in the country was not permitted; instead, the amount collected from each state must be proportional to the population (regardless of whether it was a generally poor or rich state). This proportionality aspect of the constitution was changed by the 16th amendment in 1913.

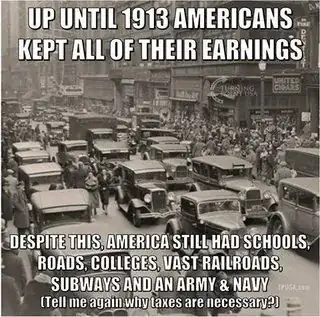

The statement in the OP is false historically for two sets of reasons.

States could and in some cases did tax earnings before 1913.

Though perhaps done in an unconstitional manner, there was also at some times federal taxation of earnings prior to 1913.

State income tax before 1913

in 1835, Pennsylvania instituted a tax on bank dividends, paid by withholding, which by about 1900 produced half its total revenue (source)

Virginia:

It is interesting to note that the 1843 income tax was enacted without

express sanction from any portion of the Virginia Constitution of that

time. The Constitutions of 1851 and 1869, however, expressly provided

for income taxation [reference 6] and the provision of the latter Constitution was

carried over into § 170 of the Constitution of 1902. Pursuant to that

Constitution, the General Assembly in 1903 enacted a comprehensive tax

bill, taxing incomes in excess of $600 per year.[reference 7] The 1903 statute related, however, only to the income of individuals and contained no provisions for

taxing corporate income. After several amendments of the Virginia income

tax, [reference 8] in 1916 the income of corporations was specifically subjected to

the same 1 per cent tax as applied to individuals.[reference 9] Finally, in 1926, the

Virginia income tax statutes were extensively rewritten, and a number of

the basic provisions relating to corporations in the present-day tax statutes

were introduced.

North Carolina :

continuously had income tax starting 1849 and extending beyond 1913

Wisconsin income tax starting in 1911

(these are just examples, not at all a complete list)

Federal income tax before 1913

Revenue Act of 1861

3% tax on all individuals whose annual incomes were above $800 per year

Revenue Act of 1862

For U.S. residents whose annual incomes were less than $600, no tax was collected.

For U.S. residents whose annual incomes were greater than $600 and less than $10,000, a percentage of 3% of total income was demanded in tax.

For U.S. residents whose annual incomes were greater than $10,000, a percentage of 5% of total income was demanded in tax. The 5% tax rate also applied to the entire U.S.-source income over $600 of U.S. citizens who resided abroad, regardless of their income, unless they worked for the United States government.

Revenue Act of 1864

0% if income under $600

5% if from $600 to 5,000

7.5% if from $5,000 to $10,000

10% if $10,000 and above

The Revenue Act of 1864 income tax was upheld in Springer v. United States, where the court quoted Alexander Hamilton as saying "direct tax" was only "capitation or poll taxes, and taxes on lands and buildings, and general assessments, whether on the whole property of individuals or on their whole real or personal estate. All else must, of necessity, be considered as indirect taxes"; and therefore the court held that income tax was not a direct tax and was permitted by the constitution without apportionment.

Revenue Act of 1894 which was found unconstitutional in Pollock v. Farmers' Loan & Trust Co.