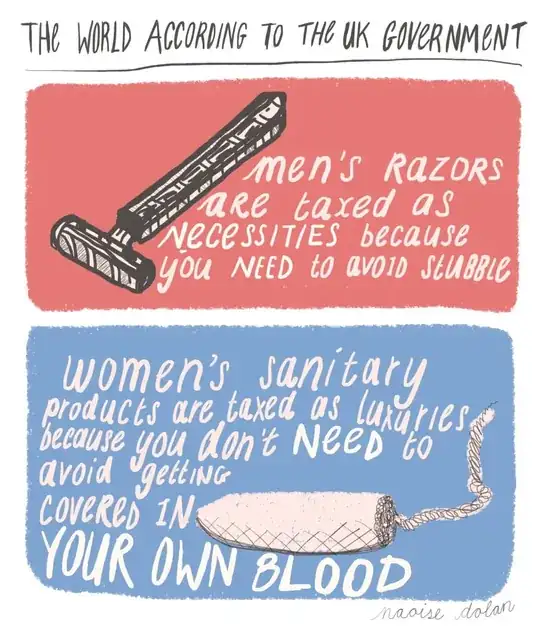

A comic by artist Naoise Dolan published March 2015 has been circulating heavily on social media:

The world according to the UK government:

- Men’s razors are taxed as necessities because you need to avoid stubble

- Women’s sanitary products are taxed as luxuries because you don’t need to avoid getting covered in your own blood

I think the tax on tampons is true but the bit about razors being VAT-free as an essential strikes me as being unlikely. Googling it finds claims from both sides:

I recognise that razors are zero-rated, and judging by many Conservative Members the opportunity to shave every day is a human right. —Stella Creasy MP, speaking in Parliament October 2015

A second MP made the same claim:

It is absurd that while men's razors, children's nappies and even products like Jaffa Cakes, exotic meats and edible cake decorations are free from VAT. —Alison Thewliss MP

Are razors (specifically men's razors if there's any difference) really VAT-free in the UK?