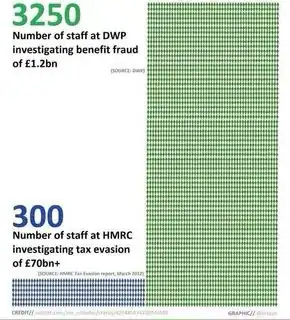

The following graphic is doing the rounds on Facebook:

Is it true?

Does the graphic give an accurate representation of the comparative headcount/effort/resources that the UK government (as a whole) puts into investigating these two things?

To what extent are the two things - benefit fraud and tax evasion - directly comparable?

Background info:

'benefits' (BrEng) = 'welfare' (AmEng)

DWP = Department of Work and Pensions (the central government department that pays benefits)

HMRC = Her Majesty's Revenue and Customs (the central government department that collects taxes)

The source is given in the graphic as:

https://twitter.com/nw_nicholas/status/420485474139246592

which is a twitter post by Nicholas Wilson saying:

Mr Ethical

@nw_nicholas.@UKuncut DWP has 3000+ staff for benefit fraud of £1.2bn; HMRC has 300 staff for tax evasion of £70bn+

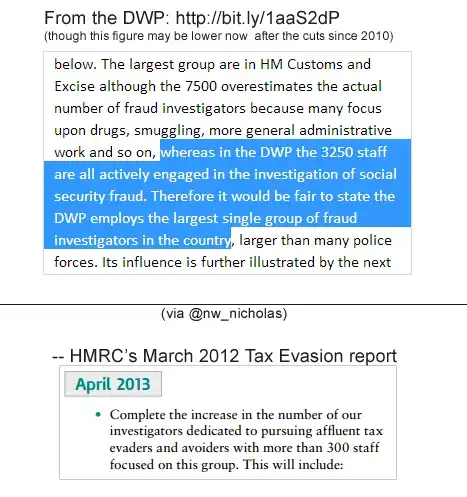

The image tweeted by nw_nicholas gives the source for the first section of text as "From the DWP" with a blt.ly shortened URL, which resolves to:

which is a page on "Fraud and the Criminal Justice System", (c) University of Portsmouth, 2012.

I don't know who is the author of the text on that page (which @nw_nicholas cites in the image on twitter), although a Google search for "the 7500 overestimates the actual number of fraud" turns up no results other than that page itself.

Portsmouth University has an Institute of Criminal Justice Studies, perhaps that's related to the document somehow.

The second document cited by Nicholas Wilson is this PDF published by HMRC:

"Closing in HMRC’s approach to tax evasion"

and the quote he gives is accurate (p11), although of course "more than 300" isn't exactly the same thing as 300 (but surely if the number were much higher than 300 then the HMRC document would use that higher number).