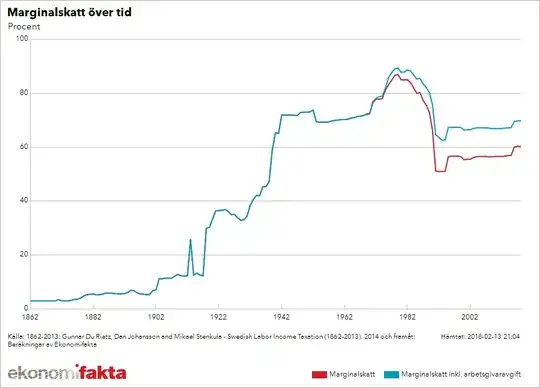

In several places I've seen the claim that some people have at some point in history paid more than 100% taxes in Sweden.

The Economist on the Nordic Countries:

Astrid Lindgren, the inventor of Pippi Longstocking, was forced to pay more than 100% of her income in taxes

For a few years, Sweden had a 102% tax rate on its highest income bracket. Everyone got so pissed off at the government that they were voted out of power the next election. Any socialists want to defend this nonsense?

This Straight Dope thread quotes a South African Business Report magazine that is unfortunately a broken link, but the quote is claimed to be:

Lobbying really started taking off when Astrid Lindgren, author of the world famous Pippi Longstocking books, pointed out that it was ridiculous for her to be paying accumulative tax to the tune of 105 percent.

None of the quotes are really convincing to me. Considering the ludicrosity of the idea of paying more than 100% taxes, I wonder — is this really true? Did anyone in Sweden ever pay more than 100% in income tax?