I have often heard people talk about to an Apple tax in reference to Apple products (especially their Mac products). This is one of many references to Apple having overly high prices compared with competitors, and is particularly popular on-line.

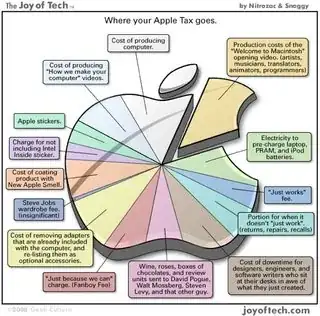

Regardless of how this is worded, the following graphic illustrates one example of such belief - that Apple charges considerably more than the cost to manufacture

However, for every proponent of Apple tax existing, there seems to be just as many who are ready to offer a "Apple products are higher quality and use higher quality components" or similar answer.

Whether or not Apple products are higher quality or not is not what I care about. I am interested in the multitude of claims which essentially state Apple has prices ridiculously higher than other products, resulting in a "tax" or premium requirement to purchase Apple products in addition to normal cost, etc.

Does such a premium exist when purchasing Apple products - ie does Apple have abnormally high prices on their products relative to functionally equivalent products from competitors?