Below is a simplified version of transaction data for stocks.

StockData =

DATATABLE (

"STOCK", STRING,

"Date", DATETIME,

"Buyer", STRING,

"Seller", STRING,

"Turnover", INTEGER,

{

{ "AAPL", "2019/04/07", "GSI", "BRC", 100 },

{ "AAPL", "2019/04/07", "CITI", "JPM", 500 },

{ "AAPL", "2019/04/07", "JPM", "GSI", 700 },

{ "AAPL", "2019/04/08", "GSI", "JPM", 300 },

{ "AAPL", "2019/04/08", "GSI", "CITI", 800 },

{ "AAPL", "2019/04/08", "JPM", "BRC", 400 },

{ "MSFT", "2019/04/07", "GSI", "GSI", 500 },

{ "MSFT", "2019/04/07", "JPM", "BRC", 700 },

{ "MSFT", "2019/04/07", "BRC", "GSI", 800 },

{ "MSFT", "2019/04/08", "GSI", "BRC", 500 },

{ "MSFT", "2019/04/08", "GSI", "JPM", 600 },

{ "MSFT", "2019/04/08", "CITI", "BRC", 500 }

}

)

Goal is to calculate net turnover by broker per day.

I can achieve this by following DAX measure

Test BRC Net Turnover =

VAR TotalBuy = CALCULATE(SUM(StockData[Turnover]),StockData[Buyer] = "BRC")

VAR TotalSell = CALCULATE(SUM(StockData[Turnover]),StockData[Seller] = "BRC")

Return TotalBuy - TotalSell

However, to get net turnover for all (Four) brokers in example data above I have to rewrite the measure four times with different critera, i.e., rather than using "BRC" I have to use "GSI" etc...

Real data set consists of 50 different broker codes so the solution with 50 different measures is not feasible.

How can I make this DAX function iterate over all Broker codes in my data set. Taking into consideration filters for the stock. I.e., if a typical broker code doesnt exist for MSFT but for AAPL the measure will take that into consideration.

I have tried the values function to return a list of all brokers, without any success.

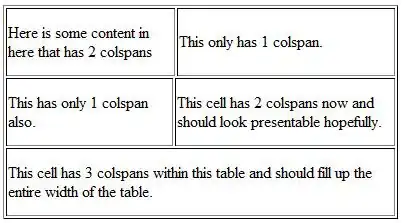

Above is what I would like to achieve with one single measure.

Many thanks